Mower-Blower Sales Co. started business on January 20, 2022. Products sold were snow blowers and lawn mowers.

Question:

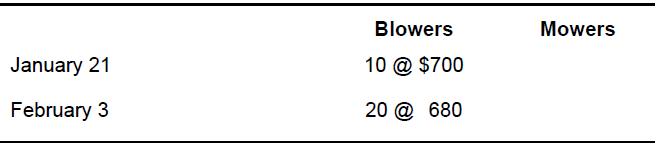

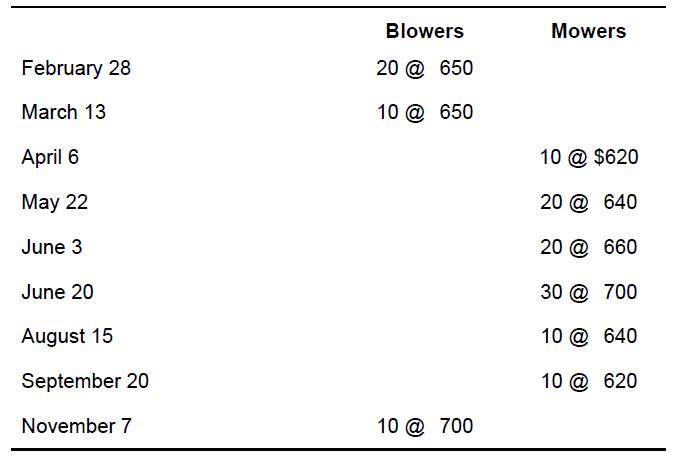

Mower-Blower Sales Co. started business on January 20, 2022. Products sold were snow blowers and lawn mowers. Each product sold for $1,400. Purchases during 2022 were as follows:

The December 31, 2022, inventory included 10 blowers and 20 mowers. Assume the company uses a periodic inventory system.

Required:

a. What will be the difference between ending inventory valuation at December 31, 2022, under the FIFO and LIFO cost flow assumptions?

b. If the cost of mowers had increased to $750 each by December 26th, and if management had purchased 20 mowers just before the end of the year, which cost flow assumption was probably being used by the firm? Explain your answer.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: