Clearcast Communications Inc. is considering allocating a limited amount of capital investment funds among four proposals. The

Question:

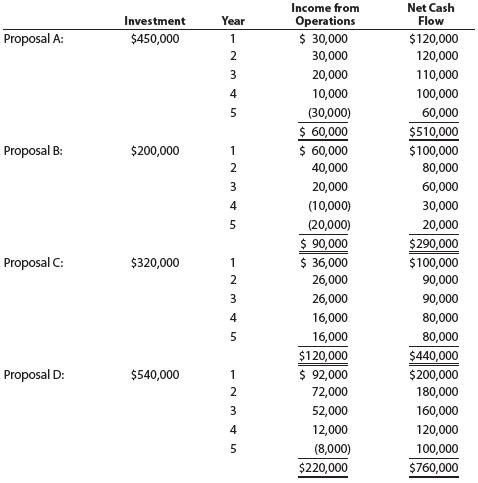

Clearcast Communications Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated income from operations, and net cash flow for each proposal are as follows:

The company’s capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on all projects. If the preceding standards are met, the net present value method and present value indexes are used to rank the remaining proposals.

Instructions

1. Compute the cash payback period for each of the four proposals.

2. Giving effect to straight-line depreciation on the investments and assuming no estimated residual value, compute the average rate of return for each of the four proposals. Round to one decimal place.

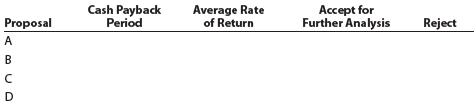

3. Using the following format, summarize the results of your computations in parts (1) and (2). By placing the calculated amounts in the first two columns on the left and by placing a check mark in the appropriate column to the right, indicate which proposals should be accepted for further analysis and which should be rejected.

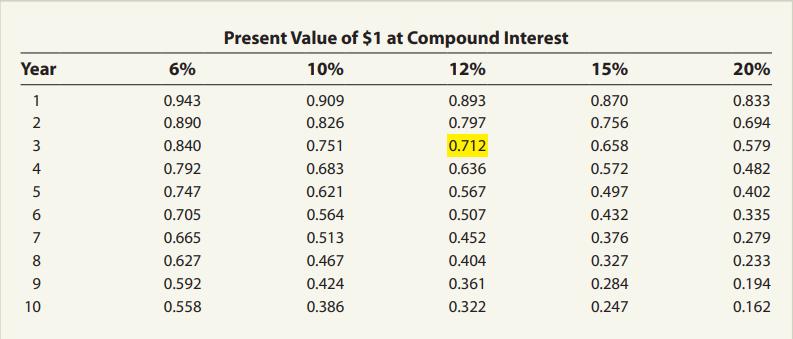

4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 12% and the present value of $1 table appearing in this chapter (Exhibit 2).

5. Compute the present value index for each of the proposals in part (4). Round to two decimal places.

6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4).

7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Round to two decimal places.

8. Based on the analyses, comment on the relative attractiveness of the proposals ranked in parts (6) and (7).

Exhibit 2:

Step by Step Answer:

Accounting

ISBN: 978-1285743615

26th edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac