First United Bank Inc. is evaluating three capital investment projects by using the net present value method.

Question:

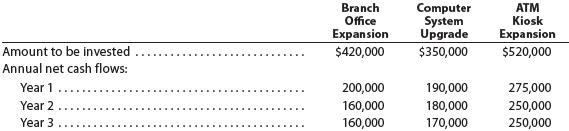

First United Bank Inc. is evaluating three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows:

Instructions

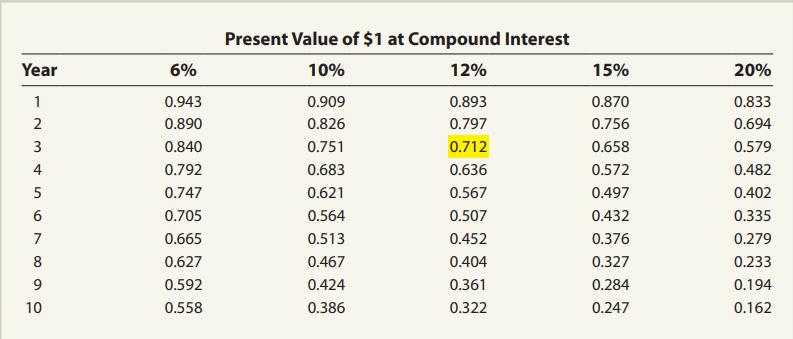

1. Assuming that the desired rate of return is 15%, prepare a net present value analysis for each project. Use the present value of $1 table appearing in this chapter (Exhibit 2).

2. Determine a present value index for each project. Round to two decimal places.

3. Which project offers the largest amount of present value per dollar of investment? Explain.

Exhibit 2:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting

ISBN: 978-1285743615

26th edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

Question Posted: