Net cash flows from financing activities were a. $(25,000) b. $(37,000) c. $(38,000) d. $(42,000) Comparative consolidated

Question:

Net cash flows from financing activities were

a. $(25,000)

b. $(37,000)

c. $(38,000)

d. $(42,000)

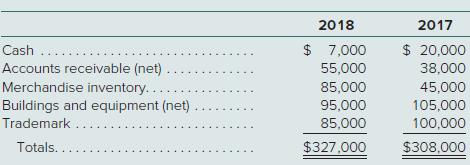

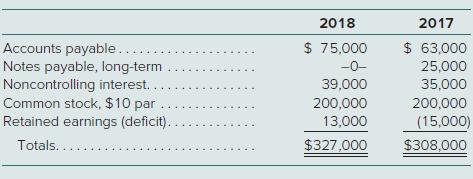

Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent–owned subsidiary Oakley Co. follow:

Additional Information for Fiscal Year 2018

∙ Iverson and Oakley’s consolidated net income was $45,000.

∙ Oakley paid $5,000 in dividends during the year. Iverson paid $12,000 in dividends.

∙ Oakley sold $11,000 worth of merchandise to Iverson during the year.

∙ There were no purchases or sales of long-term assets during the year.

In the 2018 consolidated statement of cash flows for Iverson Company:

Step by Step Answer:

Advanced Accounting

ISBN: 978-1259444951

13th edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupni