Use the following information in answering questions 1 and 2: Pop Company sells land with a book

Question:

Use the following information in answering questions 1 and 2:

Pop Company sells land with a book value of $5,000 to Son Company for $6,000 in 2016. Son is a wholly owned subsidiary of Pop. Son Company holds the land during 2017. Son Company sells the land for $8,000 to an outside entity in 2018.

1. In 2016 the unrealized gain:

a To be eliminated is affected by the noncontrolling interest percentage

b Is initially included in Son’s accounts and must be eliminated from Pop Company’s income from Son Company under the equity method

c Is eliminated from consolidated net income by a workpaper entry that includes a credit to the land account for $1,000

d Is eliminated from consolidated net income by a workpaper entry that includes a credit to the land account for $6,000

2. Which of the following statements is true?

a Under the equity method, Pop Company’s Investment in Son account will be $1,000 less than its underlying equity in Son throughout 2017.

b No workpaper adjustments for the land are required in 2017 if Pop Company has applied the equity method correctly.

c A workpaper entry debiting gain on sale of land and crediting land will be required each year until the land is sold outside the consolidated entity.

d In 2018, the year of Son’s sale to an outside entity, the workpaper adjustment for the land will include a debit to gain on sale of land for $2,000.

Use the following information in answering questions 3 and 4:

Pop Corporation sold machinery to its 80 percent–owned subsidiary, Son Corporation, for $100,000 on December 31, 2016. The cost of the machinery to Pop was $80,000, the book value at the time of sale was $60,000, and the machinery had a remaining useful life of five years.

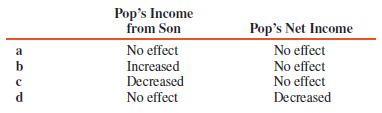

3. How will the intercompany sale affect Pop’s income from Son and Pop’s net income for 2016?

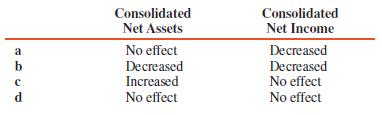

4. How will the consolidated assets and consolidated net income for 2016 be affected by the intercompany sale?

Step by Step Answer:

Advanced Accounting

ISBN: 978-0134472140

13th edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith