Werner Manufacturing had a bad year in 2012. For the first time in its history, it operated

Question:

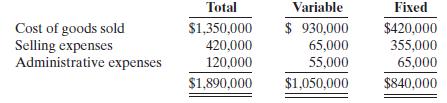

Werner Manufacturing had a bad year in 2012. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 60,000 units of product: Net sales $1,500,000; total costs and expenses $1,890,000; and net loss $390,000. Costs and expenses consisted of the amounts shown below.

Management is considering the following independent alternatives for 2013.

1. Increase unit selling price 40% with no change in costs, expenses, and sales volume.

2. Change the compensation of salespersons from fixed annual salaries totaling $200,000 to total salaries of $30,000 plus a 4% commission on net sales.

3. Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50:50.

Instructions

(a) Compute the break-even point in dollars for 2012.

(b) Compute the break-even point in dollars under each of the alternative courses of action. Which course of action do you recommend?

Step by Step Answer:

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso