Answered step by step

Verified Expert Solution

Question

1 Approved Answer

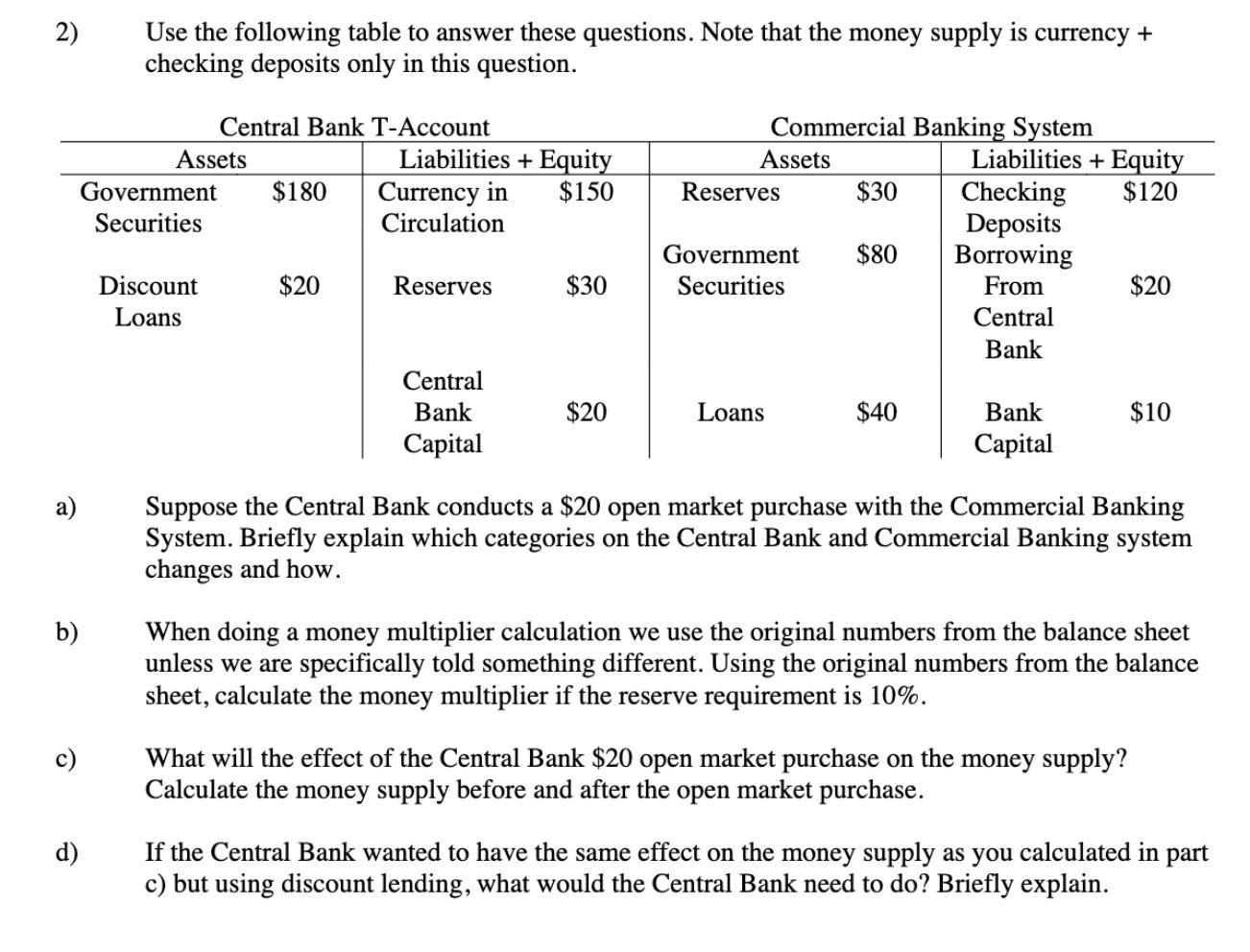

2) a) b) 6 d) Use the following table to answer these questions. Note that the money supply is currency + checking deposits only

2) a) b) 6 d) Use the following table to answer these questions. Note that the money supply is currency + checking deposits only in this question. Central Bank T-Account Assets Government $180 Securities Discount Loans $20 Liabilities + Equity Currency in $150 Circulation Reserves Central Bank Capital $30 $20 Commercial Banking System Assets Reserves $30 Government $80 Securities Loans $40 Liabilities + Equity $120 Checking Deposits Borrowing From Central Bank Bank Capital $20 $10 Suppose the Central Bank conducts a $20 open market purchase with the Commercial Banking System. Briefly explain which categories on the Central Bank and Commercial Banking system changes and how. What will the effect of the Central Bank $20 open market purchase on the money supply? Calculate the money supply before and after the open market purchase. When doing a money multiplier calculation we use the original numbers from the balance sheet unless we are specifically told something different. Using the original numbers from the balance sheet, calculate the money multiplier if the reserve requirement is 10%. If the Central Bank wanted to have the same effect on the money supply as you calculated in part c) but using discount lending, what would the Central Bank need to do? Briefly explain.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Suppose the Central Bank conducts a 20 open market purchase with the Commercial Banking System Briefly explain which categories on the Central Bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started