1. A state government has the following activities: I. State-operated lottery ($ 12,000,000) II. State-operated hospital (3,000,000)...

Question:

1. A state government has the following activities:

I. State-operated lottery \(\$ 12,000,000\)

II. State-operated hospital \(3,000,000\)

Which of these activities should be accounted for in an enterprise fund?

a. Neither I nor II.

b. II only.

c. I only,

d. Both I and II.

2. Financing for the renovation of Taft City's municipal park, begun and completed during 20X5, came from the following sources:

In its operating statement for the year ended December \(31,20 \mathrm{X} 5\), Taft should report these amounts as:

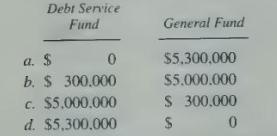

3. Bret City is accumulating financial resources that are legally restricted to payments of general obligation debt principal and interest maturing in future years. At December 31, 20X5 \(\$ 5,000,000\) has been accumulated for principal payments and \(\$ 300,000\) has been accumulated for interest payments. These restricted funds should be accounted for in the:

4. The billings for transportation services provided to other governmental units are recorded by the internal service fund as:

a. Other Financing Source-Transfers in.

\(b\). Operating revenues.

c. Interfund reimbursements.

d. Advances to other funds.

5. Wilbur City should prepare a statement of cash flows for which of the following funds?

6. Pearl County received proceeds from various towns and cities for capital projects financed by Pearl's long-term debt. A special tax was assessed by each local government, and a portion of the tax was restricted to repay the long-term debt of Pearl's capital projects. Pearl should account for the restricted portion of the special tax in which of the following funds?

a. Special revenue fund.

\(b\). Debt service fund

c. Capital projects fund.

d. Permanent Trust fund.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King