(a) Accounting for retirement benefits remains one of the most challenging areas in financial reporting. The values...

Question:

(a) Accounting for retirement benefits remains one of the most challenging areas in financial reporting. The values being reported are significant, and the estimation of these values is complex and subjective. Standard setters and preparers of financial statements find it difficult to achieve a measure of consensus on the appropriate way to deal with the assets and costs involved. SSAP 24 ‘Accounting for Pension Costs’

focused on the profit and loss account, viewing retirement benefits as an operating expense. However, FRS 17 ‘Retirement Benefits’ concentrates on the balance sheet and the valuation of the pension fund. The philosophy and rationale of the two statements are fundamentally opposed.

Required

(i) Describe four key issues in the determination of the method of accounting for retirement benefits in respect of defined benefit plans; (6 marks)

(ii) Discuss how FRS 17 ‘Retirement Benefits’ deals with these key issues and to what extent it provides solutions to the problems of accounting for retirement benefits.

(8 marks)

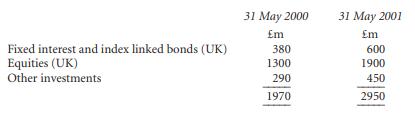

(b) A, a public limited company, operates a defined benefit pension scheme. A full actuarial valuation by an independent actuary revealed that the value of the pension liability at 31 May 2000 was £1500 million. This was updated to 31 May 2001 by the actuary and the value of the pension liability at that date was £2000 million. The pension scheme assets comprised mainly UK bonds and equities and the market value of these assets was as follows:

The pension scheme had been altered during the year with improved benefits arising for the employees and this alteration had been taken into account by the actuaries.

The increase in the actuarial liability in respect of employee service in prior periods was £25 million (past service cost). The increase in the actuarial liability resulting from employee service in the current period was £70 million (current service cost).

The company had paid contributions of £60 million to the scheme during the period. The company expects its return on the pension scheme assets at 31 May 2001 to be £295 million and the interest on pension liabilities to be £230 million.

The company anticipates that a deferred tax liability will arise on the surplus in the scheme. Assume Corporation Tax is at a rate of 30 per cent.

Required (i) Show the amount which will be shown as the net pension asset/pension reserve in the balance sheet of A plc as at 31 May 2001 under FRS 17, ‘Retirement Benefits’ (comparative figures are not required). (4 marks)

(ii) Show a reconciliation of the movement in the pension surplus during the year stating those amounts which would be charged to operating profit and the amounts which would be recognised in the Statement of Total Recognised Gains and Losses (STRGL), utilising FRS 17, ‘Retirement Benefits’. (7 marks)

ACCA, Financial Reporting Environment (UK Stream), June 2001 (25 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey