Alamo Inc. purchased 80 percent of the outstanding stock of Western Ranching Company, a company located in

Question:

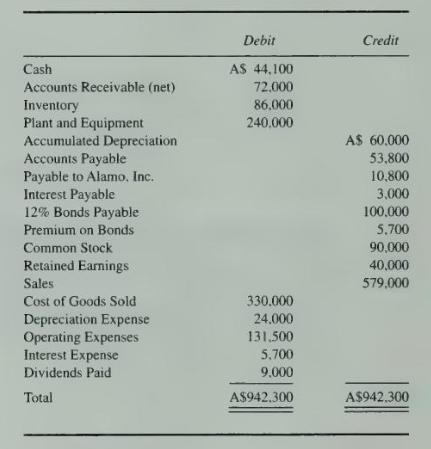

Alamo Inc. purchased 80 percent of the outstanding stock of Western Ranching Company, a company located in Australia, on January 1, 20X3. The purchase price was A \(\$ 200,000\), and A \(\$ 40,000\) of the differential was allocated to plant and equipment which is amortized over a 10 year period. The remainder of the differential was attributable to a patent. Alamo, Inc., amortizes the patent over 10 years. Western Ranching Company's trial balance on December 31, 20X3, in Australian dollars (A\$) is as follows:

1. Western Ranching Company uses average cost for cost of goods sold. Inventory increased by A \(\$ 20,000\) during the year. Purchases were made uniformly during 20X3. The ending inventory was acquired at the average exchange rate for the year.

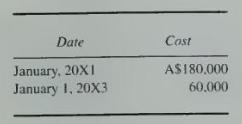

2. Plant and equipment were acquired as follows:

3. Plant and equipment are depreciated using the straight-line method, a 10 -year life, and no residual value.

4. The payable to Alamo Inc. is in Australian dollars. Alamo's books show a receivable from Western Ranching Company of \(\$ 6,480\).

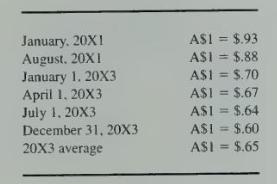

5. The 10 -year bonds were issued on July \(1,20 \times 3\), for \(\mathrm{A} \$ 106,000\). The premium is amortized on a straight-line basis. The interest is paid on April 1 and October 1.

6. The dividends were declared and paid on April 1.

7. Exchange rates were as follows:

\section*{Required}

a. Prepare a schedule translating the December 31, 20X3, trial balance of Western Ranching Company from Australian dollars to U.S. dollars.

b. Prepare a schedule providing a proof of the translation adjustment.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King