Apple Corporation acquires 80 percent of Berry Corporations common shares on January 1, 20X2. On January 2,

Question:

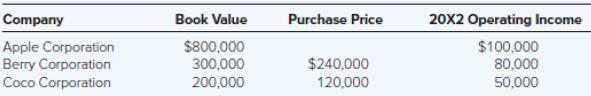

Apple Corporation acquires 80 percent of Berry Corporation’s common shares on January 1, 20X2. On January 2, 20X2, Berry acquires 60 percent of Coco Corporation’s common stock. Information on company book values on the date of purchase and operating results for 20X2 is as follows:

The fair values of the noncontrolling interests of Berry and Coco at the dates of acquisition were $60,000 and $80,000, respectively.

Required

Select the correct answer for each of the following questions.

1. Consolidated net income assigned to the controlling interest for 20X2 is

a. $180,000

b. $188,000

c. $194,000

d. $234,000

2. The amount of 20X2 income assigned to the noncontrolling interest of Coco Corporation is

a. $0

b. $20,000c. $30,000

d. $50,000

3. The amount of 20X2 income assigned to the noncontrolling interest of Berry Corporation is

a. $10,000

b. $16,000

c. $22,000

d. $26,0004. The amount of income assigned to the noncontrolling interest in the 20X2 consolidated income statement is

a. $20,000

b. $22,000

c. $42,000

d. $46,000

5. Assume that Berry pays $150,000, rather than $120,000, to purchase 60 percent of Coco’s common stock, and the fair value of the noncontrolling interest is $100,000 at the date of acquisition. If the differential is amortized over 10 years, the effect on 20X2 income assigned to the controlling shareholders will be a decrease of

a. $0

b. $2,400

c. $3,000

d. $5,000

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd