Balance sheet and summarized income statement data for Amber Corporation, Blair Corporation, and Carmen Corporation at January

Question:

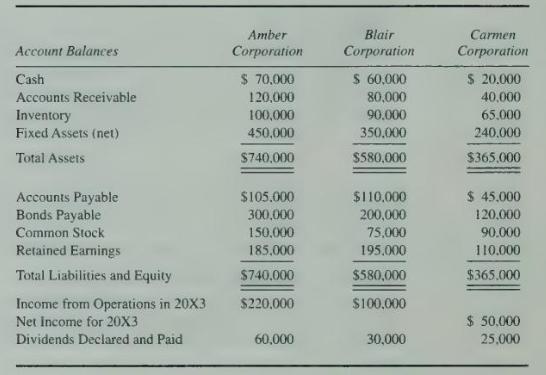

Balance sheet and summarized income statement data for Amber Corporation, Blair Corporation, and Carmen Corporation at January 1, 20X3, were as follows:

On January 1, 20X3, Amber Corporation purchased 40 percent of the voting common stock of Blair Corporation by issuing common stock with a par value of \(\$ 40.000\) and fair value of \(\$ 130,000\). Immediately after this transaction, Blair Corporation purchased 25 percent of the voting common stock of Carmen Corporation by issuing bonds payable with a par value and market value of \(\$ 51,500\).

On January 1, 20X3, the book values of Blair's net assets were equal to their fair values except for equipment which had a fair value \(\$ 30,000\) greater than book value and patents which had a fair value \(\$ 25,000\) greater than book value. At that date the equipment had a remaining economic life of eight years and the patents had a remaining economic life of five years. The book values of Carmen's assets were equal to their fair values except for inventory which had a fair value \(\$ 6,000\) in excess of book value and was accounted for on a FIFO basis.

\section*{Required}

a. Compute the net income reported by Amber Corporation for 20X3, assuming the equity method is used by Amber and Blair in accounting for their intercorporate investments.

b. Give all journal entries recorded by Amber Corporation relating to its investment in Blair Corporation during 20X3.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King