Bell Company purchased 60 percent ownership of Troll Corporation on January 1, 20X1, for ($ 83,000). On

Question:

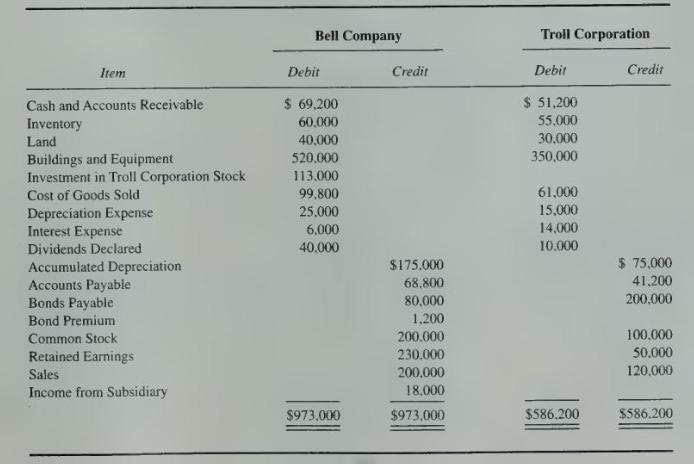

Bell Company purchased 60 percent ownership of Troll Corporation on January 1, 20X1, for \(\$ 83,000\). On that date, Troll reported common stock outstanding of \(\$ 100,000\) and retained earnings of \(\$ 20,000\). The purchase differential is assigned to land to be used as a future building site. Bell uses the equity method in accounting for its ownership of Troll. On December 31, 20X2, the trial balances of the two companies are as follows:

Troll sold inventory costing \(\$ 25,500\) to Bell for \(\$ 42,500\) in \(20 \mathrm{X} 1\). Bell resold 80 percent of the purchase in 20X1 and the remainder in 20X2. Troll sold inventory costing \(\$ 21,000\) to Bell in 20X2 for \(\$ 35,000\), and Bell resold 70 percent prior to December 31, 20X2. In addition, Bell sold inventory costing \(\$ 14,000\) to Troll for \(\$ 28,000\) in \(20 \mathrm{X} 2\), and Troll resold all but \(\$ 13,000\) of its purchase prior to December 31, 20X2.

\section*{Required}

a. Record the journal entry or entries for \(20 \times 2\) on the books of Bell Company related to its investment in Troll Corporation, using the basic equity method.

b. Prepare the elimination entries needed to complete a consolidated workpaper for \(20 \mathrm{X} 2\).

c. Prepare a three-part consolidation workpaper for 20X2.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King