Buster Products Corporation acquired 90 percent ownership of Sanford Company on October 20, (20 mathrm{X} 2), through

Question:

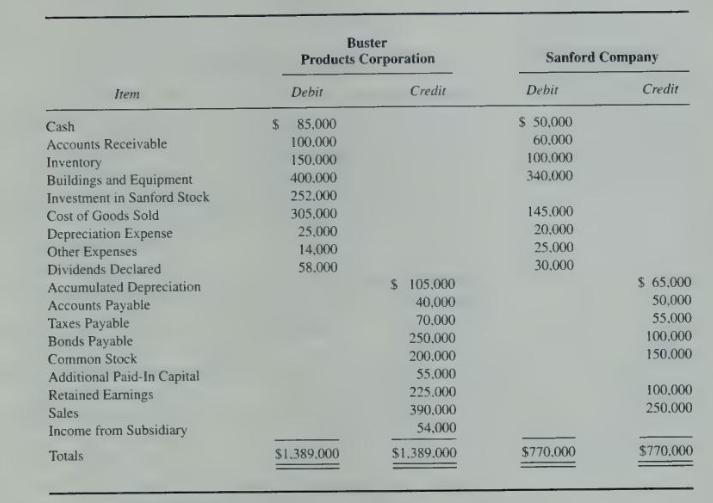

Buster Products Corporation acquired 90 percent ownership of Sanford Company on October 20, \(20 \mathrm{X} 2\), through an exchange of voting shares in a transaction qualifying as a pooling of interests. Buster Products issued 8.000 shares of its \(\$ 10\) par stock to acquire 27.000 shares of Sanford Company \(\$ 5\) par stock. Trial balances of the two companies on December 31, 20X2, are as follows:

In 20X2, Sanford Company reported net income of \(\$ 45,000\) before its acquisition by Buster Products and \(\$ 15,000\) after acquisition. Sanford Company paid dividends of \(\$ 20,000\) in April and \(\$ 10,000\) in November of 20X2. Buster Products Corporation paid dividends of \(\$ 40,000\) in 20X2. Buster Products uses the equity method in accounting for its investment in Sanford.

\section*{Required}

a. Give all journal entries recorded by Buster Products Corporation during 20X2 that relate to its investment in Sanford Company.

b. Give the workpaper elimination entries needed on December \(31,20 \times 2\), to prepare consolidated financial statements.

c. Prepare a three-part consolidation workpaper as of December 31, \(20 \mathrm{X} 2\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King