Calvin Inc. has operating segments in five different industries: apparel, building, chemical, furniture, and machinery. Data for

Question:

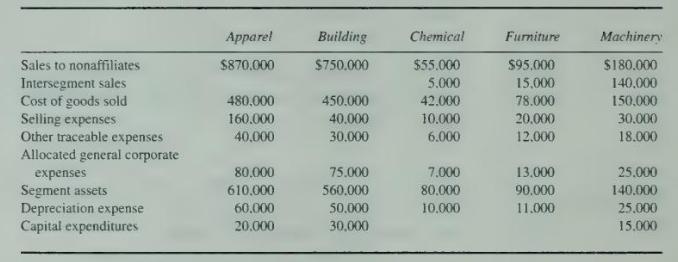

Calvin Inc. has operating segments in five different industries: apparel, building, chemical, furniture, and machinery. Data for the five segments for 20X1 are as follows:

1. The corporate headquarters had general corporate expenses totaling \(\$ 235,000\). For internal reporting purposes, \(\$ 200,000\) of these expenses were allocated to the divisions based on their cost of goods sold. The other corporate expenses are not used in segmental decision making by the chief operating officer.

2. The company has an intercorporate transfer pricing policy that all intersegment sales shall be priced at cost.

3. Corporate headquarters had assets of \(\$ 125,000\) that are not used in segmental decision making by the chief operating officer.

\section*{Required}

a. Prepare a segmental disclosure workpaper for Calvin Inc.

b. Prepare schedules to show which segments are separately reportable.

c. Prepare the information about the company's operations in different industry segments as required by FASB 131.

d. Would there be any differences in the specification of reportable segments if the building segment had \(\$ 460,000\) in assets instead of \(\$ 560,000\). and the furniture segment had \(\$ 190,000\) in assets instead of \(\$ 90,000\) ? Justify your answer by preparing a schedule showing the percentages for each of the three 10 percent segment tests for each of the five segments using these new amounts for segment assets.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King