Capital plc carried on business in four product segments, namely aircraft design, hairdressing salons, import agencies and

Question:

Capital plc carried on business in four product segments, namely aircraft design, hairdressing salons, import agencies and beauty products.

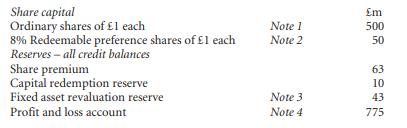

The directors are now considering the dividend policy and the future capital structure of the company The draft accounts of Capital plc as at 30 November 1995 showed the following share capital and reserves:

Note 1 The market value of ordinary shares as at 30 November 1995 was £1.60.

Note 2 The redeemable preference shares were issued in 1985. They are redeemable at par.

Note 3 A revaluation reserve of £45 million was created on 1 December 1994 on the revaluation of some of the buildings. A debit of £2 million was made to the reserve in 1995 arising from a permanent fall in value on the revaluation of certain computer equipment.

Note 4 The profit and loss account of Capital plc for the year ended 30 November 1995 contained the following items:

(i) Exchange gain on a long-term German mark loan taken out on 1 December 1994 £6m (ii) Depreciation based on historic cost of fixed assets £68m Additional depreciation based on revalued amount of fixed assets £13m (iii) Development costs for the year written off £22m (iv) Profit attributed to long-term contracts in beauty products £9m At their next meeting the directors will be considering proposals for:

(a) the purchase ‘off market’ at £1.50 per share of 30% of the issued ordinary shares of Capital plc which are currently held by Venture plc, a venture capital company. The directors consider that the shares are substantially undervalued and that the company should purchase the shares and hold them as an investment classified under ‘own shares’ in the balance sheet;

(b) the redemption of the preference shares;

(c) the distribution to the shareholders of Capital plc of shares in Kind plc, which have been held as an investment. The investment appears at cost, £15 million, in the balance sheet and the directors estimate that it has a market value of £24 million at 30 November 1995;

(d) a bonus issue of one ordinary share for every 20 ordinary shares held; and

(e) the amount of the final dividend to recommend for 1995.

The finance director has been requested to present a report in relation to these proposals.

Required

(a) (i) Advise the board on its proposed procedure for purchasing the issued shares in Capital plc held by Venture plc and on its intention to hold these as an investment.

(ii) Draft the journal entries to record the purchase transaction assuming that the board acts in accordance with the requirements of the Companies Act 1985. (4 marks)

(b) (i) Explain the definition of distributable profits in a public company (ignore the rules relating to investment companies).

(ii) Identify which of the proposals

(a) to

(e) above would be classified as a distribution.

(iii) Describe the accounting treatment of proposal (c), distribution of shares held as an investment in Kind plc. (5 marks)

(c) Calculate the distributable profits as at 30 November 1995 on the assumption that the company had redeemed the preference shares and made the bonus issue but delayed action on the purchase of own shares and the distribution of the shares in Kind plc until 1996. Explain clearly your treatment of each item mentioned in the reserves. (11 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey