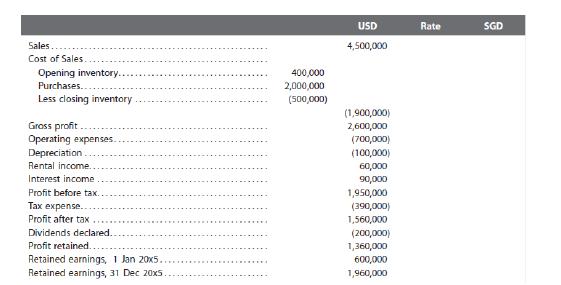

Co Y is an associate of Investor Co. Co Ys functional currency is the USD. Translate the

Question:

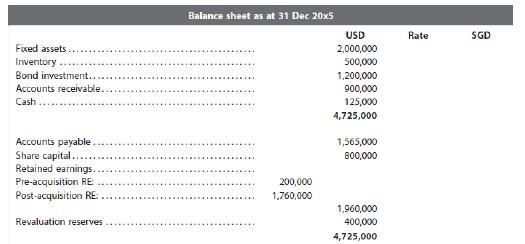

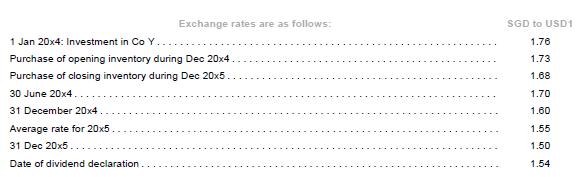

Co Y is an associate of Investor Co. Co Y’s functional currency is the USD. Translate the USD financial statements into Investor Co’s presentation currency, the SGD.

Co Y revalued its fixed assets on 31 Dec 20x4.

Assume that sales, purchases, other income, operating expenses, and tax are spread evenly throughout the year.

![]()

Investor Co paid US$600,000 to acquire a 40% interest in Co Y on 1 January 20x4. On 1 January 20x4, Co Y had inventory whose fair value exceeded the book value by US$50,000. The inventory was sold on 30 June 20x4. Tax rate is 20% throughout.

Required

(a) Translate the financial statements into the presentation currency.

(b) Show the movements in net exposed items of Co Y for the year ended 31 December 20x5 as an analytical check of your computation.

(c) Prepare the equity accounting entries for Co Y for the year ended 31 December 20x5.

(d) Perform an analytical check of the Investment in Co Y as at 31 December 20x5.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah