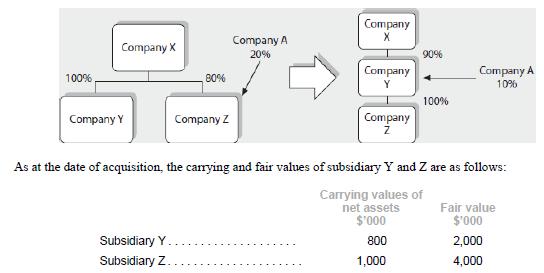

Company X owns 100% of Company Y and 80% of Company Z. The remaining 20% are held

Question:

Company X owns 100% of Company Y and 80% of Company Z. The remaining 20% are held by a third party, Company A. On 1 August 20x5, Company Y obtains 100% control of Company Z by issuing its shares to acquire Company X’s 80% interest in Company C and Company A’s 20% interest in Company Z as set out below. The amount of shares issued is based on Company Y’s interest in the fair value of Company Z at the date of transfer. As a result of the issuance of shares by Company Y, Company A’s interest in Company B is diluted to 90%.

All companies within the group have December year ends and they meet the definition of a business.

The carrying value of net assets of Company Z is represented by share capital and retained earnings of $300,000 and $700,000, respectively.

Assuming the Company Y restates its financial statements for the period before the common control transaction as if the transaction had occurred before 1 August 20x5, prepare the accounting entries for the transaction for both the separate and consolidated financial statements of Company Y.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah