Diamonds Ltd has issued share capital of 2,000,000 ordinary shares as at 31 December 20x6. Profit for

Question:

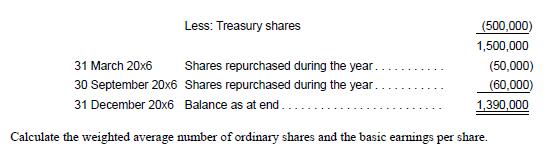

Diamonds Ltd has issued share capital of 2,000,000 ordinary shares as at 31 December 20x6. Profit for the year attributable to ordinary shareholders amounted to $6.5 million. In 20x2, a total of 500,000 were repurchased from the market under the company’s share repurchase mandate and held in treasury. In 20x6, the company bought back another two tranches of shares from the market. 50,000 and 60,000 shares were repurchased on 31 March 20x6 and 30 September 20x6 respectively. Similarly, these shares are not cancelled and are held in treasury. The following table shows the movement in the share capital account.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah

Question Posted: