Duckworth Corporation purchases an 80% interest in Panda Corporation on January 1, 2017, in exchange for 5,000

Question:

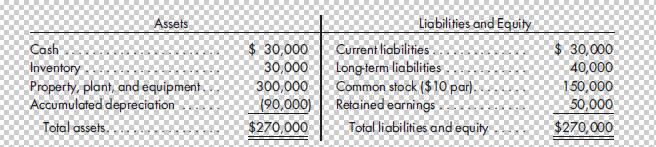

Duckworth Corporation purchases an 80% interest in Panda Corporation on January 1, 2017, in exchange for 5,000 Duckworth shares (market value of $18) plus $155,000 cash. The fair value of the NCI is proportionate to the price paid by Duckworth for its interest. The appraisal shows that some of Panda’s equipment, with a 4-year estimated remaining life, is undervalued by $20,000. The excess is attributed to goodwill. Panda Corporation’s balance sheet on December 31, 2016

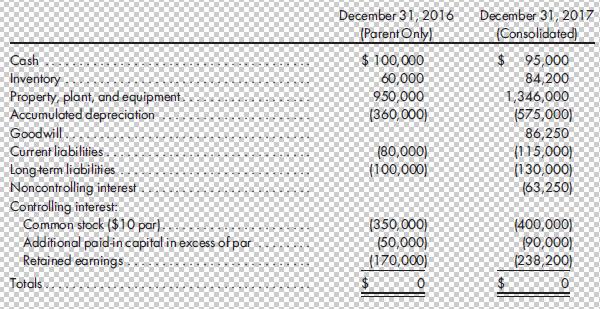

Comparative balance sheet data are as follows:

The following information relates to the activities of the two companies for 2017:

a. Panda pays off $10,000 of its long-term debt.

b. Duckworth purchases production equipment for $76,000.

c. Consolidated net income is $103,200; the NCI’s share is $5,000. Depreciation expense taken by Duckworth and Panda on their separate books is $92,000 and $28,000, respectively.

d. Duckworth pays $30,000 in dividends; Panda pays $15,000.

Prepare the consolidated statement of cash flows for the year ended December 31, 2017, for Duckworth Corporation and its subsidiary, Panda Corporation.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng