Eagle Company purchased the net assets of Lark Corporation on January 3, 20X2, for ($ 565,000) cash.

Question:

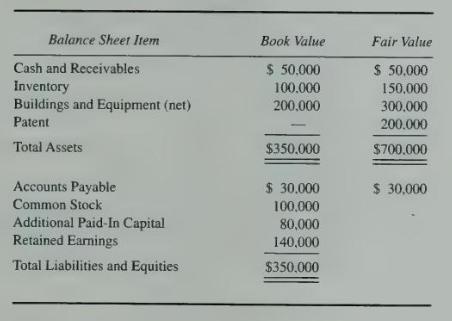

Eagle Company purchased the net assets of Lark Corporation on January 3, 20X2, for \(\$ 565,000\) cash. In addition, \(\$ 5,000\) of direct costs were incurred in consummating the combination. At the time of acquisition Lark Corporation reported the following historical cost and current market data:

\section*{Required}

Give the journal entry or entries recorded by Eagle Company to record its purchase of the net assets of Lark Corporation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King

Question Posted: