Emma Inc. acquired all the outstanding ($ 25) par value common stock of Steed Inc. on June

Question:

Emma Inc. acquired all the outstanding \(\$ 25\) par value common stock of Steed Inc. on June 30, \(20 X 7\), in exchange for 40,000 shares of its \(\$ 25\) par value common stock. The business combination meets all conditions for a pooling of interests. On June 30, 20X7, Emma's common stock closed at \$65 per share on a national stock exchange. Both corporations continued to operate as separate businesses maintaining separate accounting records with years ending December 31 .

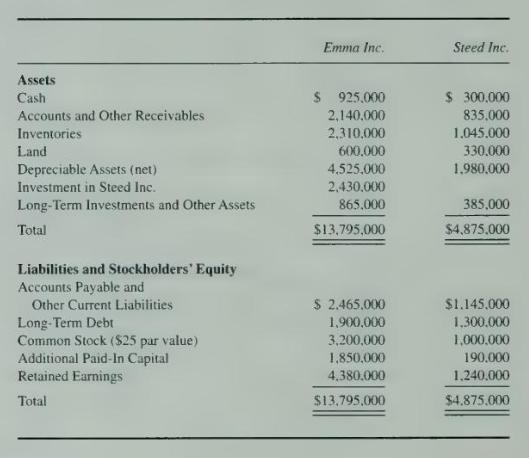

On December 31, 20X7, after year-end adjustments and closing nominal accounts, the companies had condensed balance sheet accounts as follows:

1. Emma uses the equity method of accounting for its investment in Steed. The investment in Steed has not been adjusted for any intercompany transactions.

2. On June \(30,20 \times 7\), Steed's assets and liabilities had fair values equal to the book balances, with the exception of land, which had a fair value of \(\$ 550,000\).

3. On June 15, 20X7. Steed paid a cash dividend of \(\$ 4\) per share on its common stock.

4. On December 10, 20X7, Emma paid a cash dividend totaling \(\$ 256,000\) on its common stock.

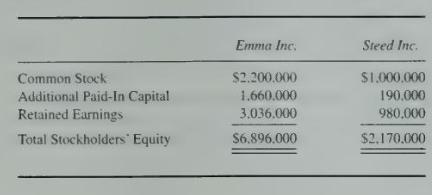

5. On June 30, 20X7, immediately before the combination, the stockholders equities were:

6. Steed's long-term debt consisted of 10 percent 10 -year bonds issued at face value on March 31 , 20X1. Interest is payable semiannually on March 31 and September 30. Emma had purchased Steed's bonds at face value of \(\$ 320,000\) in 20X1, and there was no change in ownership through December 31, 20X7.

7. During October 20X7. Emma sold merchandise to Steed at an aggregate invoice price of \(\$ 720.000\), which included a profit of \(\$ 180.000\). At December 31,20X7, one-half of the merchandise remained in Steed's inventory, and Steed had not paid Emma for the merchandise purchased.

8. Steed's \(20 \times 7\) net income was \(\$ 580.000\). Emma's \(20 \times 7\) income before considering equity in Steed's net income was \(\$ 890.000\).

9. The balances in retained earnings at December 31, 20X6, were \(\$ 2,506,000\) and \(\$ 820,000\) for Emma and Steed, respectively.

\section*{Required}

a. Develop and complete a workpaper for the preparation of a consolidated balance sheet of Emma Inc. and its subsidiary. Steed Inc., at December 31, 20X7. A formal consolidated balance sheet and joumal entries are not required.

b. Prepare a formal consolidated statement of retained earnings for the year ended December 31 , 20X7.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King