Entity A purchases motorcycles from Italy, Germany and Japan. It sells to domestic and foreign customers. Entity

Question:

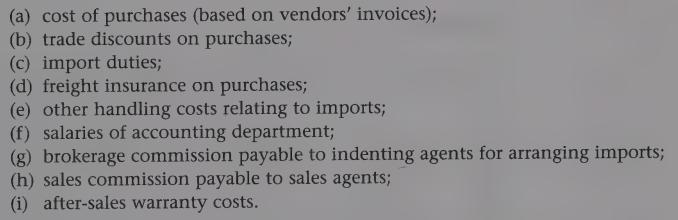

Entity A purchases motorcycles from Italy, Germany and Japan. It sells to domestic and foreign customers. Entity A incurred the following expenses during 2010:

Entity A seeks your advice on which costs are permitted under IAS 2 to be included in the cost of inventory.

Transcribed Image Text:

(a) cost of purchases (based on vendors' invoices); (b) trade discounts on purchases; (c) import duties; (d) freight insurance on purchases; (e) other handling costs relating to imports; (f) salaries of accounting department; (g) brokerage commission payable to indenting agents for arranging imports; (h) sales commission payable to sales agents; (i) after-sales warranty costs.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

IAS 2 Inventories prescribes the accounting treatment for inventories and provides guidance on determining their cost and subsequent recognition as an ...View the full answer

Answered By

Anurag Agrawal

I am a highly enthusiastic person who likes to explain concepts in simplified language. Be it in my job role as a manager of 4 people or when I used to take classes for specially able kids at our university. I did this continuously for 3 years and my god, that was so fulfilling. Sometimes I've skipped my own classes just to teach these kids and help them get their fair share of opportunities, which they would have missed out on. This was the key driver for me during that time. But since I've joined my job I wasn't able to make time for my passion of teaching due to hectic schedules. But now I've made a commitment to teach for at least an hour a day.

I am highly proficient in school level math and science and reasonably good for college level. In addition to this I am especially interested in courses related to finance and economics. In quest to learn I recently gave the CFA level 1 in Dec 19, hopefully I'll clear it. Finger's crossed :)

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone

Question Posted:

Students also viewed these Business questions

-

1. Sargent Pharmaceuticals develops and produces injectable medicines used in chemotherapy treatments for cancer patients. Neil manages the Kansas City facility for an annual salary of $90,000....

-

Matthew B. (age 42) and Shelli R. (age 48) Thomson are married and live at 7605 Walnut Street, Kansas City, MO 64114. Matthew is a chemist employed by Sargent Pharmaceuticals, Inc., and Shelli is a...

-

Simon Ltd are a manufacturing company with a financial year end 31 December 2020. The following 2 items took place during the year ended 31 December 2020. ITEM 1 Simon Ltd commenced the...

-

The _____________ works out the best way to structure finances and make effective financial decisions.

-

If two successive overtones of a vibrating string are 280Hz and 350 Hz, what is the frequency of the fundamental?

-

Xr11-34 Spam e-mail has become a serious and costly nuisance. An office manager believes that the average amount of time spent by office workers reading and deleting spam exceeds 25 minutes per day....

-

14. Assume that one stock follows the process dS/S = dt + dZ (44) Another stock follows the process dQ/Q = Qdt + dZ + dq1+ dq2 (45) (Note that the dZ terms for S and Q are identical.) Neither stock...

-

Class Printing Supply of Baltimore has applied for a loan. Its bank has requested a budgeted balance sheet at April 30, 2014, and a budgeted statement of cash flows for April. The March 31, 2014,...

-

Compute the amount of interest on $ 8 3 5 at 7 . 5 % p . a . from October 8 , 2 0 1 9 , to August 4 , 2 0 2 0

-

Entity B is a newly established international trading company. It commenced its operations in 2008. Entity B imports goods from China and sells in the local market. It uses the FIFO method to value...

-

(a) In what circumstances should assumptions be made in order to assign a cost fo inventory items when they are sold? (b) What is the difference between FIFO, LIFO and AVCO cost formulas? (c) Compare...

-

A 10-in plastic butterfly valve carries 5000 gal/min of liquid propane at 77F. Compute the expected pressure drop across the valve.

-

Bybee Printing makes custom posters and is currently considering making large-scale outdoor banners as well. Which one of the following is the best example of an incremental operating cash flow...

-

https://filmsfortheearth.org/en/film/humans-destroyers-of-earth/ This documentary will give you more insight into the speed at which globalization has taken place during the dawn of...

-

1. Write and explain (through comment or description after the program) a complete C program to perform the following activities: a. Take Student ID as user input from keyboard (2) b. Determine the...

-

Assume that I have a Company uses a job costing system with machine hours as the allocation base for overhead. The company uses normal costing to develop the overhead allocation rate. The following...

-

(CASE STUDY )Company Information: ABC Company is a large automotive dealer company operating in the field of automobile retailing that is owned by a big Holding Group Company XYZ. ABC Company buys...

-

A pump raises the pressure of water, flowing at a rate of 0.1 m3/s, from 70 kPa to a pressure of 150 kPa. The inlet and exit areas are 0.05 m2 and 0.02 m2 respectively. Assuming the pump to be...

-

H Corporation has a bond outstanding. It has a coupon rate of 8 percent and a $1000 par value. The bond has 6 years left to maturity but could be called after three years for $1000 plus a call...

-

Paper Company acquired 80 percent of Scissor Company's outstanding common stock for $296,000 on January 1, 20X8, when the book value of Scissor's net assets was equal to $370,000. Problem 3-37...

-

Parsons Corporation purchased 75 percent ownership of Tumble Company on December 31, 20X7, for $210,000. Summarized balance sheet amounts for the companies on December 31, 20X7, prior to the...

-

Parsons Corporation purchased 75 percent ownership of Tumble Company on December 31, 20X7, for $210,000. Summarized balance sheet amounts for the companies on December 31, 20X7, prior to the...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Brief Exercise 10-6 Flint Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $327,600. The estimated fair values of the assets are land $62,400, building...

-

"faithful respresentation" is the overriding principle that should be followed in ones prepaparation of IFRS-based financial statement. what is it? explain it fully quoting IAS. how this this...

Study smarter with the SolutionInn App