Entity E has the following assets and liabilities recorded in its balance sheet as at 31 December

Question:

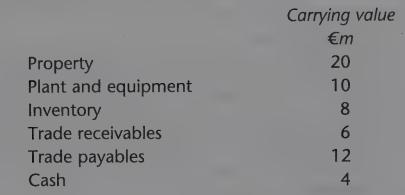

Entity E has the following assets and liabilities recorded in its balance sheet as at 31 December 2009:

The values for tax purposes of property and for plant and equipment are EUR 14m and EUR 8m respectively. Entity E has made a provision for inventory obsolescence of EUR 4m, which is not allowable for tax purposes until the inventory is sold. ‘Further, an impairment charge against trade receivables of EUR 2m has been made. This charge will not be allowed in the current year for tax purposes but will be allowed in the future. Income tax paid is at 30 per cent.

Calculate the deferred tax provision at 31 December 2009.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone

Question Posted: