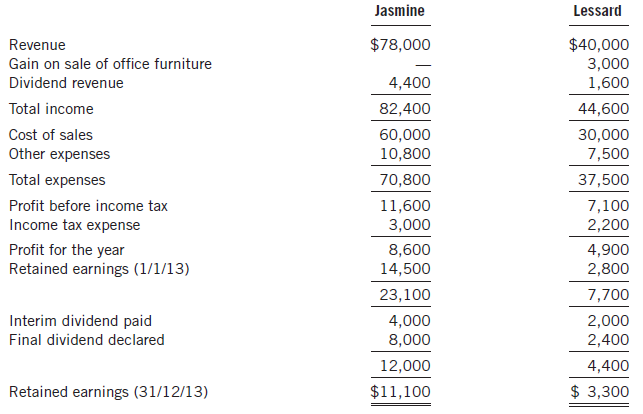

Financial information for Jasmine and Lessard for the year ended December 31, 2013, is shown below: Additional

Question:

Financial information for Jasmine and Lessard for the year ended December 31, 2013, is shown below:

Additional information:

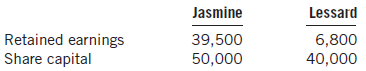

1. On January 1, 2012, Jasmine purchased 100% of the shares of Lessard for $50,000. At that date the equity of the two entities was as follows:

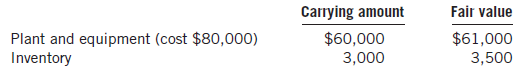

At January 1, 2012, all the identifiable assets and liabilities of Lessard were recorded at fair value except for the following:

All of this inventory was sold by December 2012. The plant and equipment had a further five-year life.

2. Jasmine records dividends receivable as revenue when dividends are declared.

3. The opening inventory of Lessard included goods that cost Lessard $2,000. Lessard purchased this inventory from Jasmine at cost plus 33 1/3%.

4. Intragroup sales totalled $10,000 for the year. Sales from Jasmine to Lessard, at cost plus 10%, amounted to $5,600 and are still in the closing inventory of Lessard. The closing inventory of Jasmine included goods that cost it $4,400. Jasmine purchased this inventory from Lessard at cost plus 10%.

5. On December 31, 2012, Lessard sold Jasmine offi ce furniture for $3,000. This furniture originally cost Lessard $3,000 and was written down to $2,500 when sold. Jasmine depreciates furniture at the rate of 10% p.a. on cost.

6. During the year, Jasmine paid rent of $7,000 to Lessard.

7. The tax rate is 30%.

Required

Prepare the consolidated statement of comprehensive income for the year ended December 31, 2013.

Step by Step Answer: