If Apollos functional currency is the FC, which of the following statements holds? (a) A translation gain

Question:

If Apollo’s functional currency is the FC, which of the following statements holds?

(a) A translation gain of $480,000 is recorded in income.

(b) A translation loss of $480,000 is taken to Foreign Currency Translation Reserve.

(c) A translation gain of $480,000 is taken to Foreign Currency Translation Reserve.

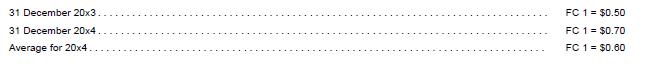

(d) A translation gain of $100,000 is recorded in income On 31 December 20x3, Zeus Ltd, whose functional currency is the dollar ($), incorporated a subsidiary, Apollo (X) Ltd, in country X, whose currency was the FC. Apollo operated a car rental business. The company was incorporated with a paid-up capital of FC 2,000,000. On 31 December 20x3, Apollo purchased a fleet of cars that cost FC 2,000,000. During 20x4, Apollo earned FC 1,000,000 from rental income. Depreciation for the year was FC 200,000. At the end of 20x4, Apollo had a cash balance of FC 1,000,000. Exchange rates are as follows:

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah