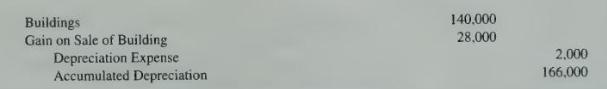

In preparing its consolidated financial statements at December (31,20 times 7), the following eliminating entry was included

Question:

In preparing its consolidated financial statements at December \(31,20 \times 7\), the following eliminating entry was included in the consolidation workpaper of Master Corporation:

Master Corporation owns 60 percent of the voting common stock of Rakel Corporation. On January 1, 20X7, Rakel sold a building it purchased for \(\$ 600 \Omega 00\) on January 1, 20X1, and depreciated on a 20 -year straight-line basis, to Master Corporation. Master Corporation recorded depreciation for \(20 \times 7\) using straight-line depreciation and the same useful life and residual value as Rakel.

\section*{Required}

\section*{6)}

a. What amount did Master pay Rakel for the building?

b. What amount of accumulated depreciation did Rakel report at January 1, 20X7, just prior to the sale?

c. What annual depreciation expense was recorded by Rakel prior to the sale?

d. What was the expected residual value used by Rakel in computing its annual depreciation expense?

e. What amount of depreciation expense did Master record in 20X7?

f. If Rakel reported net income of \(\$ 80,000\) for \(20 \times 7\), what amount of income will be assigned to the noncontrolling interest in the consolidated income statement for 20X7?

g. If Rakel reported net income of \(\$ 65,000\) for \(20 \mathrm{X} 8\), what amount of income will be assigned to the noncontrolling interest in the consolidated income statement for 20X8?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King