Keller Corporation acquired 75 percent of the ownership of Tropic Company on January 1, 20X1. The purchase

Question:

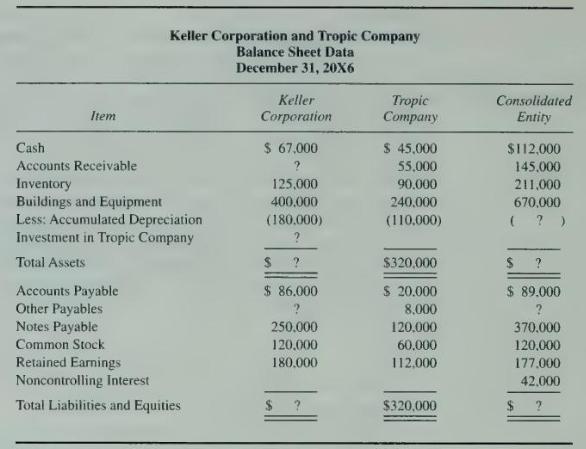

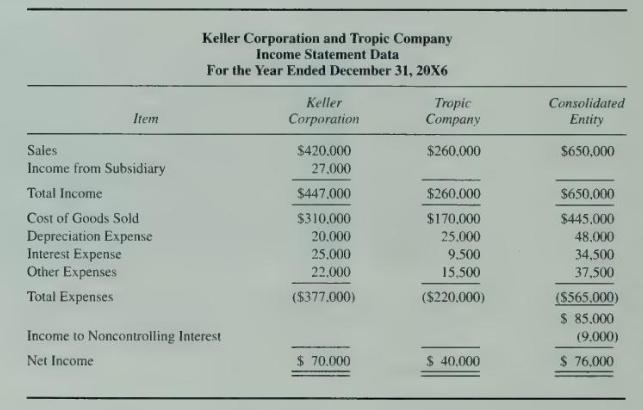

Keller Corporation acquired 75 percent of the ownership of Tropic Company on January 1, 20X1. The purchase differential paid by Keller is assigned to buildings and equipment and expensed over 10 years. Financial statement data for the two companies and the consolidated entity at December \(31,20 \mathrm{X} 6\), are as follows:

\section*{Required}

a. What amount of purchase differential was paid by Keller in acquiring its ownership of Tropic?

b. What amount should be reported as accumulated depreciation for the consolidated entity at December 31, 20X6?

c. If Tropic reported retained earnings of \(\$ 30,000\) on January 1, 20X1, what amount did Keller pay to acquire its ownership in Tropic?

d. What balance does Keller report as its investment in Tropic at December 31, 20X6?

e. What amount of intercorporate sales of inventory occurred in 20X6?

f. What amount of unrealized inventory profit exists at December 31, 20X6?

g. Assuming all unrealized profits on intercompany inventory sales at January 1, 20X6, were on Keller's books, were the inventory sales during 20X6 upstream or downstream? How do you know?

h. Give the eliminating entry used in eliminating intercompany inventory sales during 20X6.

\(i\). Assuming all unrealized profits on intercompany inventory sales at January 1, 20X6, were on Keller's books, what was the amount of unrealized profit at January 1, 20X6?

\(j\). What balance in accounts receivable was reported by Keller at December 31, 20X6?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King