Kendel Manufacturing Corporation purchased 60 percent of the outstanding stock of Trendy Products Corporation on January 1,

Question:

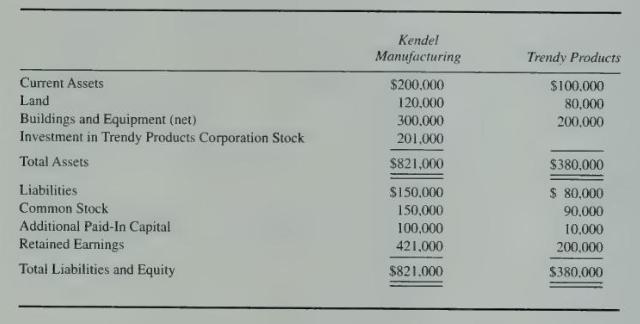

Kendel Manufacturing Corporation purchased 60 percent of the outstanding stock of Trendy Products Corporation on January 1, 20X2. Trendy reported retained earnings of \(\$ 120,000\) at the date of acquisition. The price paid for Trendy's stock included \(\$ 30,000\) that was attributable to identifiable intangible assets with a remaining life of 10 years. Summarized balance sheet data for December \(31,20 \times 4\), are as follows:

Kendel Manufacturing uses the basic equity method in accounting for its investment in Trendy Products. For the year ended December 31, 20X4, Trendy Products reported net income of \(\$ 40,000\) and paid dividends of \(\$ 15,000\); Kendel Manufacturing reported income from its separate operations of \(\$ 75,000\) and paid dividends of \(\$ 55,000\).

Kendel Manufacturing sold land that it had purchased for \(\$ 25,000\) to Trendy Products for \(\$ 45,000\) on December 31, 20X3. On January 1, 20X4, Trendy Products sold equipment with a book value of \(\$ 48,000\) to Kendel Manufacturing for \(\$ 58,000\). The equipment had an estimated economic life of five years at the time of intercorporate transfer.

\section*{Required}

1. What amount of income will be assigned to noncontrolling shareholders in the \(20 \times 4\) consolidated income statement?

a. \(\$ 4,000\).

b. \(\$ 12,000\).

c. \(\$ 12,800\).

d. \(\$ 16,800\).

2. What amount will be reported as identifiable intangible assets in the consolidated balance sheet on December 31, 20X4?

a. \(\$ 12,600\).

b. \(\$ 21,000\).

c. \(\$ 24,000\).

d. \(\$ 30,000\).

3. What amount of buildings and equipment (net) will be reported in the consolidated balance sheet on December 31, 20X4?

a. \(\$ 490,000\).

b. \(\$ 492,000\).

c. \(\$ 494,000\).

d. \(\$ 495,000\).

e. \(\$ 500,000\).

4. What amount of land will be reported in the consolidated balance sheet on December 31, 20X4?

a. \(\$ 120,000\).

b. \(\$ 180,000\).

c. \(\$ 188,000\).

d. \(\$ 200,000\).

5. What amount of consolidated net income will be reported for 20X4?

a. \(\$ 91,200\).

b. \(\$ 99,000\).

c. \(\$ 104,000\).

d. \(\$ 112,000\).

e. \(\$ 115,000\).

6. What amount of consolidated retained earnings will be reported in the consolidated balance sheet on December 31, 20X4?

a. \(\$ 396,200\).

b. \(\$ 516,200\).

c. \(\$ 566,200\).

d. \(\$ 568,200\).

e. \(\$ 596.200\).

7. What balance will be reported for the noncontrolling interest in the December \(31,20 \times 4\), consolidated balance sheet?

a. \(\$ 108.000\).

b. \(\$ 116,000\).

c. \(\$ 116,800\).

d. \(\$ 120.000\).

8. What amount was reported as noncontrolling interest in the consolidated balance sheet prepared as of December 31, 20X3?

a. \(\$ 102,000\).

b. \(\$ 110,000\).

c. \(\$ 120.000\).

d. \(\$ 122.000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King