Master Corporation acquired 80 percent ownership of Stanley Wood Products Company on January 1, 20X1, for $160,000.

Question:

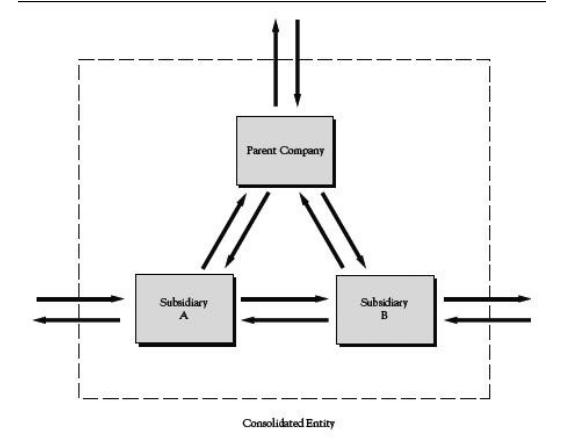

Master Corporation acquired 80 percent ownership of Stanley Wood Products Company on January 1, 20X1, for $160,000. On that date, the fair value of the noncontrolling interest was $40,000, and Stanley reported retained earnings of $50,000 and had $100,000 of common stock outstanding. Master has used the cost method in recording its investment in Stanley.

Additional Information

Additional Information

1. On the date of combination, the fair value of Stanley's depreciable assets was $50,000 more than book value. The differential assigned to depreciable assets should be written off over the following 10-year period.

2. There was $10,000 of intercorporate receivables and payables at the end of 20X5.

Required

a. Give all journal entries that Master recorded during 20X5 related to its investment in Stanley.

b. Give all eliminating entries needed to prepare consolidated statements for 20X5.

c. Prepare a three-part consolidation workpaper as of December 31, 20X5.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0073526911

8th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey