Matching Partnership Terms with Their Descriptions} section*{Required} Match the descriptions of terms on the left with the

Question:

Matching Partnership Terms with Their Descriptions}

\section*{Required}

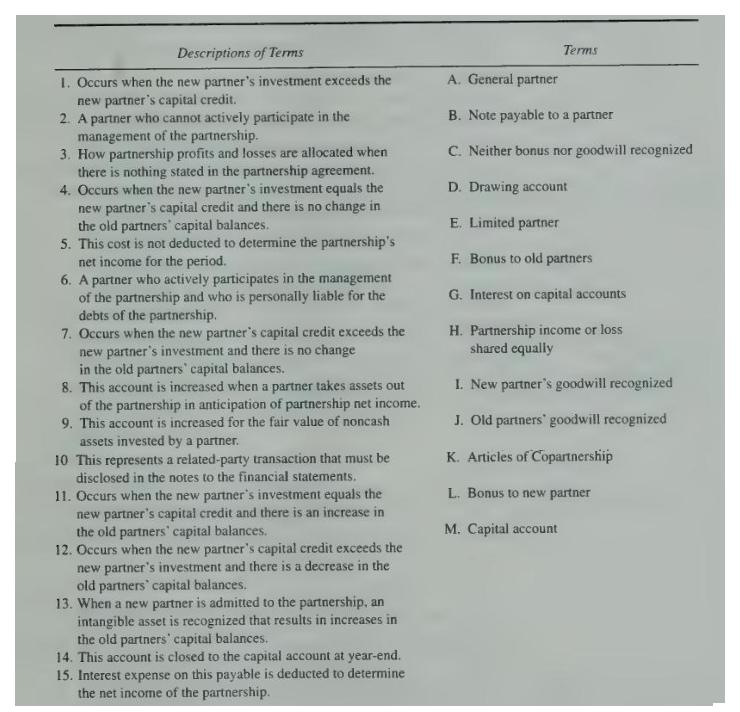

Match the descriptions of terms on the left with the terms on the right. A term may be used once, more than once, or not at all.

Transcribed Image Text:

Descriptions of Terms 1. Occurs when the new partner's investment exceeds the new partner's capital credit. 2. A partner who cannot actively participate in the management of the partnership. 3. How partnership profits and losses are allocated when there is nothing stated in the partnership agreement. 4. Occurs when the new partner's investment equals the new partner's capital credit and there is no change in the old partners' capital balances. 5. This cost is not deducted to determine the partnership's net income for the period. 6. A partner who actively participates in the management of the partnership and who is personally liable for the debts of the partnership. 7. Occurs when the new partner's capital credit exceeds the new partner's investment and there is no change in the old partners' capital balances. 8. This account is increased when a partner takes assets out of the partnership in anticipation of partnership net income. 9. This account is increased for the fair value of noncash assets invested by a partner. 10 This represents a related-party transaction that must be disclosed in the notes to the financial statements. 11. Occurs when the new partner's investment equals the new partner's capital credit and there is an increase in the old partners' capital balances. 12. Occurs when the new partner's capital credit exceeds the new partner's investment and there is a decrease in the old partners' capital balances. 13. When a new partner is admitted to the partnership, an intangible asset is recognized that results in increases in the old partners' capital balances. 14. This account is closed to the capital account at year-end. 15. Interest expense on this payable is deducted to determine the net income of the partnership. A. General partner Terms B. Note payable to a partner C. Neither bonus nor goodwill recognized D. Drawing account E. Limited partner F. Bonus to old partners G. Interest on capital accounts H. Partnership income or loss shared equally I. New partner's goodwill recognized J. Old partners' goodwill recognized K. Articles of Copartnership L. Bonus to new partner M. Capital account

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King

Question Posted:

Students also viewed these Business questions

-

i need help from section 3 part A I have already posted this and you asked me to post under advanced option Assignment Tier 1 Financial Planning (Tier1FPPA_AS_v1A3) Page 2 of 92 Student...

-

Im having trouble with question 3 part A of the attached file. I know and understand her needs but im not sure if im filling out the table correctly ? Assignment Tier 1 Financial Planning...

-

Matching Partnership Terms with Their Descriptions Required Match the descriptions on the left with the terms on the right. A term may be used once, more than once, or not at all. Descriptions of...

-

Calculate the binding energy per nucleon for a 14/7N nucleus.

-

The deuteron, has a mass that is smaller than the sum of the masses of its constituents, the proton plus the neutron. Explain why this is so. H.

-

What is an example of an industry that you think a best-cost strategy could be successful? How would you differentiate a company to achieve success in this industry?

-

16-10. De qu manera el margen de utilidad (markup) original difiere del margen de utilidad (markup) sostenido ?

-

Calculating a Bid Price Consider a project to supply 100 million postage stamps per year to the U.s. Postal Service for the next five years, you have an idle parcel of land available that cost...

-

ges,... Read more 7:14 pm you are required to do a mind map and collage that are both related to you. Autobiography is a story about yourself. In this assignment, you don't have to write about...

-

In the GMP partnership, the capital balances of Mary, Gene, and Pat, who share income in the ratio of \(6: 3: 1\). are: \section*{Required} a. If no goodwill or bonus is recorded, how much must Elan...

-

The income statement for the Apple-Jack Partnership for the year ended December 31, 20X5, appears below: 1. Apple began the year with a capital balance of \(\$ 40,800\). 2. Jack began the year with a...

-

Gives a function (x), a point c, and a positive number . Find L = lim xc (x). Then find a number > 0 such that for all x 0 < x c < 8 - U |f(x) - L < .

-

In the circuit of Fig. 4-51 write two loop equations using I 1 and I 2 . Then find the currents and node voltages. A 3A ( 4 3 V 792 B +1 D w 392 12 C

-

The capacitor in the circuit shown in Fig. 7-37 has initial charge Q 0 = 800 C, with polarity as indicated. If the switch is closed at t = 0, obtain the current and charge, for t > 0. 100 V (+ 10 4 F

-

A gift shop sells 400 boxes of scented candles a year. The ordering cost is \($60\) for scented candles, and holding cost is \($24\) per box per year. What is the economic order size for scented...

-

Kay Vickery is angry with Gene Libby. He is behind schedule developing supporting material for tomorrows capital budget committee meeting. When she approached him about his apparent lackadaisical...

-

Tharpe Painting Company is considering whether to purchase a new spray paint machine that costs \($3,000\) . The machine is expected to save labor, increasing net income by \($450\) per year. The...

-

Airway Leasing entered into an agreement to lease aircraft to Ouachita Airlines. Consider each of the following, ae, to be independent scenarios. a. The agreement calls for ownership of the aircraft...

-

Match each of the key terms with the definition that best fits it. _______________ A record of the sequence of data entries and the date of those entries. Here are the key terms from the chapter. The...

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App