Mayne Manufacturing Company has incurred substantial losses for several years and has become insolvent. On March 31,

Question:

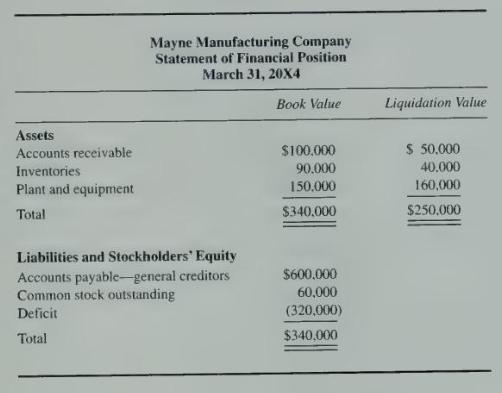

Mayne Manufacturing Company has incurred substantial losses for several years and has become insolvent. On March 31, 20X4, Mayne petitioned the court for protection from creditors and submitted the following statement of financial position:

Mayne's management informed the court that the company has developed a new product and that a prospective customer is willing to sign a contract for the purchase of 10,000 units of this product during the year ending March \(31,20 \mathrm{X} 5 ; 12,000\) units of this product during the year ending March 31, 20X6; and 15,000 units of this product during the year ending March 31, 20X7, at a price of \(\$ 90\) per unit. This product can be manufactured using Mayne's present facilities. Monthly production with immediate delivery is expected to be uniform within each year. Receivables are expected to be collected during the calendar month following sales.

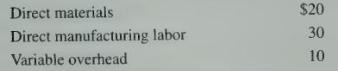

Unit production costs of the new product are expected to be as follows:.

Purchases of direct materials will be paid during the calendar month following purchase. Fixed costs, direct manufacturing labor, and variable overhead will be paid as incurred. Inventory of direct materials will be equal to 60 days' usage. After the first month of operations, 30 days' usage of materials will be ordered each month.

The general creditors have agreed to reduce their total claims to 60 percent of their March 31 , 20X4, balances, under the following conditions:

a. Existing accounts receivable and inventories are to be liquidated immediately, with the proceeds turned over to the general creditors.

\(b\). The balance of reduced accounts payable is to be paid as cash is generated from future operations, but in no event later than March 31, 20X6. No interest will be paid on these obligations.

Under this proposed plan, the general creditors would receive \(\$ 110,000\) more than the current liquidation value of Mayne's assets. The court has engaged you to determine the feasibility of the plan.

\section*{Required}

Provide the dollar amounts for each of the Items 1 through 10 that will be used in determining the feasibility of the liquidation plan.

1. Cash collections from customers for the year ending March 31, 20X5.

2. Total cash disbursements for operations for the year ending March 31, 20X5 3. Cost of direct materials required for production for the year ending March 31, 20X5.

4. Disbursements for direct materials for the year ending March 31, 20X6.

5. Cash received from liquidation of accounts receivable and inventories.

6. Payments made to general creditors in the year ended March 31, 20X6.

7. Direct materials inventory balance at March 31, 20X6.

8. Accounts payable balance at March 31, 20X6.

9. Disbursements for direct manufacturing labor for the year ended March 31, 20X5.

10. Disbursements for variable overhead for the year ended March 31, 20X6.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King