Medical Equipment plc was incorporated in 1970 to assemble medical equipment used in hospitals. The directors of

Question:

Medical Equipment plc was incorporated in 1970 to assemble medical equipment used in hospitals. The directors of the company had a major shareholding and were all engaged full time in the operational management of the company. The company had experienced operating losses and the directors believed that profit improvement depended on reducing labour costs. They accordingly decided to automate the assembly process by investing in the development of an automatic machine known as 'Auto-Assembler'.

The 'Auto-Assembler' was tested and developed in 1990 and by 31 December 1990 development expenditure of \(£ 157300\) incurred in the development of the 'AutoAssembler' has been capitalised. It was estimated that its operational use would result in cost savings of \(£ 130000\) per annum before tax and that it could be made operational in 1991 for a capital outlay of \(£ 75000\). The directors had been building up a short-term investment during 1989-1990 to cover this capital outlay.

The production engineer estimated that as a result of automation an additional \(£ 40000\) investment would be required for working capital to meet the additional cost of higher specification materials.

In December 1990 the manager of the bank informed the directors that he wanted the overdraft reduced to around \(£ 75000\) from its present level of \(£ 270480\).

The directors immediately approached \(\mathrm{Mr}\) Jeremiah, a partner in the accounting firm of Hard Reality \& Co. who were the company's auditors. They believed in the potential profitability of the new automated assembly process and advised \(\mathrm{Mr}\) Jeremiah that they believed that they would be able to negotiate long-term loan finance to clear the overdraft. At the request of the accountants the company produced the following:

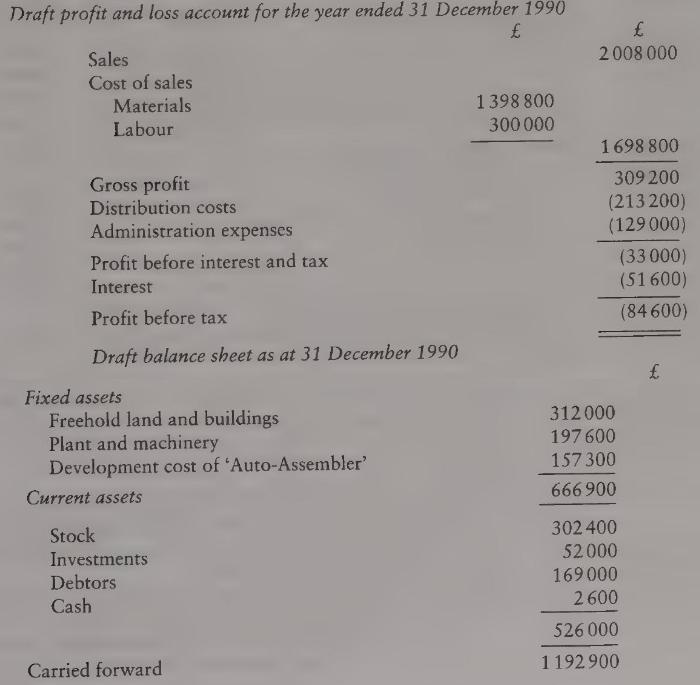

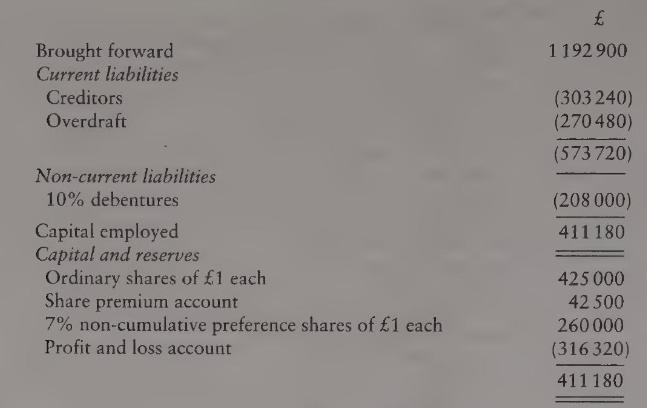

(i) draft accounts as at 31 December 1990

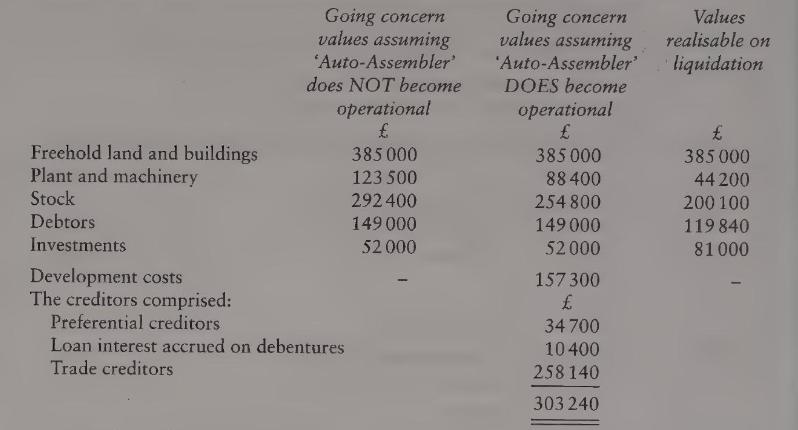

(ii) additional information on assets and liabilities.

Draft profit and loss account for the year ended 31 December 1990

Additional information on individual assets and liabilities as at 31 December 1990:

Trade creditors allow 60 days' credit.

The debentures were secured on the freehold land and buildings and were redeemable at par in 1997.

Mr Jeremiah was not convinced that the directors would be able to arrange long-term loan finance to replace the overdraft and was of the opinion that a scheme of internal reconstruction would become necessary. He requested one of his staff to draft a brief report to explain to the directors feasible ways forward.

\section*{Required}

(a) Prepare a balance sheet as at 31 December 1990 on the basis that the company ceased trading on that date and explain its significance for the relevant parties.

(b) (i) Explain briefly the purposes of a scheme for reconstruction as it would apply to equity and loan stockholders.

(ii) Propose a scheme for the capital reconstruction of Medical Equipment plc.

Show your calculation of the loss involved in the scheme; state what you would do with this loss; calculate the working capital requirements of the company; calculate the possible additional equity capital that might be required.

The revised balance sheet after the implementation of the scheme is not required.

(iii) Explain briefly to the directors how the scheme will be fair to all relevant parties.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780273638339

6th Edition

Authors: Richard Lewis, David Pendrill