Mega Retail Corporation purchased 80 percent of the voting shares of Dime Store Enterprises on January 1,

Question:

Mega Retail Corporation purchased 80 percent of the voting shares of Dime Store Enterprises on January 1, 20X4, for \(\$ 227,200\). On that date Dime Store Enterprises reported retained earnings of \(\$ 50,000\) and common stock outstanding of \(\$ 200,000\).

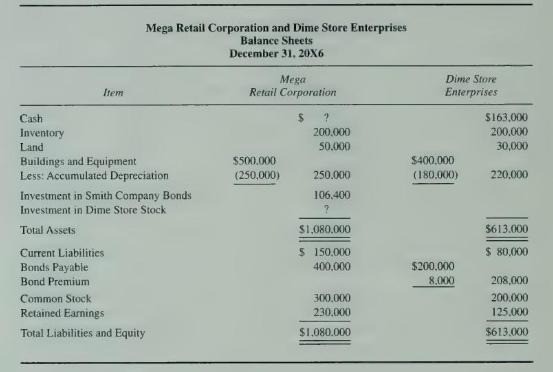

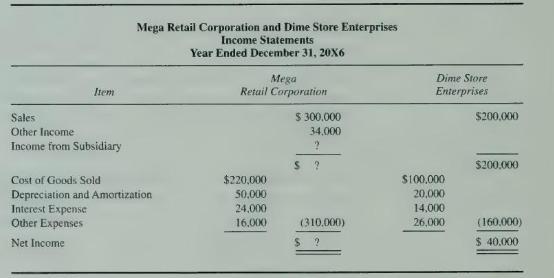

Partial balance sheets and income statements for the companies are available at December 31, 20X6, as follows:

On the date of combination, all Dime Store's assets were carried at book values that were equal to their market values except for buildings, which had a fair value of \(\$ 30,000\) greater than book value. The buildings had an expected 10 -year remaining life on that date. At the end of each year, the management of Mega Retail has reviewed the amount attributed to goodwill as a result of its purchase of Dime Store shares and found no evidence of impairment.

Dime Store sells part of its inventory to Mega Retail each year. During 20X5, Dime Store sold goods costing \(\$ 30,000\) to Mega Retail for \(\$ 35,000\). Mega resold 60 percent of the inventory in 20X5 and 40 percent in 20X6. In 20X6, Dime Store sold goods costing \(\$ 50,000\) to Mega Retail for \(\$ 70.000\). and Mega resold 70 percent of the goods during 20X6.

During 20X6, Mega Retail Corporation paid dividends of \(\$ 20.000\), and Dime Store Enterprises paid dividends of \(\$ 15,000\).

\section*{Required}

Select the correct answer for each of the following questions.

1. What total amount of depreciation and amortization will be reported in the \(20 \mathrm{X} 6\) consolidated income statement?

a. \(\$ 70,000\).

b. \(\$ 72,400\).

c. \(\$ 73,000\).

d. \(\$ 72,720\).

2. What amount of inventory will be reported in the consolidated balance sheet as of December 31, 20X6?

a. \(\$ 380,000\).

b. \(\$ 394.000\).

c. \(\$ 396,000\).

d. \(\$ 400,000\).

3. What amount of cost of goods sold will be reported in the \(20 \mathrm{X} 6\) consolidated income statement?

a. \(\$ 248,000\).

b. \(\$ 254,000\).

c. \(\$ 256,000\).

d. \(\$ 320,000\).

4. What was the amount of unamortized purchase differential on January 1, 20X6?

a. \(\$ 19,200\).

b. \(\$ 22,400\).

c. \(\$ 24,000\).

d. \(\$ 27,200\).

e. \(\$ 32,000\).

5. What amount of goodwill will be reported in the December \(31,20 \times 6\), consolidated balance sheet?

a. \(\$ 0\).

b. \(\$ 3,200\).

c. \(\$ 22,400\).

d. \(\$ 24,000\).

e. \(\$ 27,200\).

6. What amount of income will be assigned to the noncontrolling interest in the \(20 \times 6\) consolidated income statement?

a. \(\$ 6,800\).

b. \(\$ 7,200\).

c. \(\$ 8,000\).

d. \(\$ 8.400\).

7. What amount will be reported as the noncontrolling shareholders' claim in the consolidated balance sheet as of December 31, 20X6?

a. \(\$ 59,000\).

b. \(\$ 63,800\).

c. \(\$ 64,200\).

d. \(\$ 65,000\).

8. What is consolidated net income for 20X6?

a. \(\$ 50.400\).

b. \(\$ 52,800\).

c. \(\$ 56,000\).

d. \(\$ 57,600\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King