Merchant Company had the following foreign currency transactions: 1. On November 1, 20X6. Merchant sold goods to

Question:

Merchant Company had the following foreign currency transactions:

1. On November 1, 20X6. Merchant sold goods to a company located in Munich, Germany. The receivable was to be settled in German marks on February 1, 20X7, with the receipt of DM 250,000 by Merchant Company.

2. On November 1. 20X6. Merchant purchased machine parts from a company located in Berlin, Germany. Merchant is to pay DM 125,000 on February 1, 20X7.

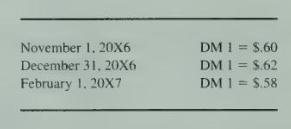

The direct exchange rates for the following dates were:

\section*{Required}

a. Prepare T-accounts for the following five accounts related to the transactions above: Foreign Currency Units (DM), Accounts Receivable (DM), Accounts Payable (DM). Foreign Currency Transaction Loss, and Foreign Currency Transaction Gain.

b. Within the \(\mathrm{T}\)-accounts you have prepared, appropriately record the following items:

1. The November 1, 20X6. export transaction (sale).

2. The November 1, 20X6, import transaction (purchase).

3. The December 31, 20X6, year-end adjustment required of the foreign currency-denominated receivable of DM 250,000 .

4. The December 31, 20X6, year-end adjustment required of the foreign currency-denominated payable of DM 125,000 .

5. The February 1, 20X7, adjusting entry to determine the U.S. dollar equivalent value of the foreign currency receivable on that date.

6. The February \(1,20 \times 7\), adjusting entry to determine the U.S. dollar equivalent value of the foreign currency payable on that date.

7. The February 1, 20X7, settlement of the foreign currency receivable.

8. The February \(1,20 \times 7\), settlement of the foreign currency payable.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King