Mr Kumars chemist shop derives income from both retail sales and prescription charges made to the NHS

Question:

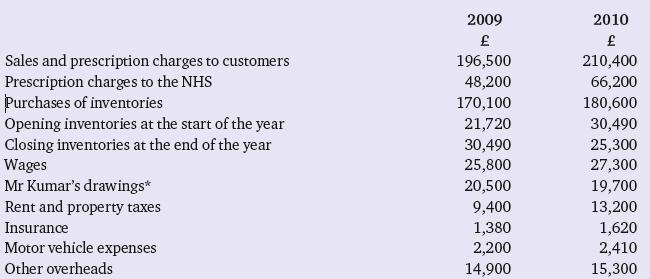

Mr Kumar’s chemist shop derives income from both retail sales and prescription charges made to the NHS and customers. For the last two years 31 December 2009 and 31 December 2010, his results were as follows:

Rent for the year 2009 includes £2,400 paid in advance for the half year to 31 March 2010, and for 2010 includes £3,600 paid in advance for the half year to 31 March 2011. Other overheads for 2009 do not include the electricity invoice for £430 for the final quarter (included in 2010 other overheads).

There is a similar electricity invoice for £510 for 2010. Depreciation may be ignored.

(i) Prepare an income statement for the two years to 31 December.

(ii) Why do you think that there is a difference in the gross profit to sales % between the two years?

(iii) Using Mr Kumar’s business as an example, explain the accruals accounting concept and examine whether or not it has been complied with.

Step by Step Answer: