Obscure Advertising and Brown Company are considering joining forces in a business combination to be recorded as

Question:

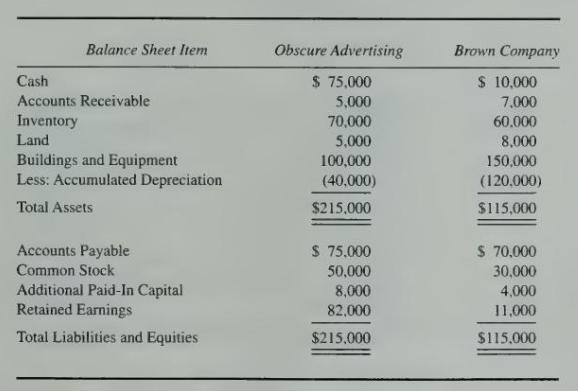

Obscure Advertising and Brown Company are considering joining forces in a business combination to be recorded as a pooling of interests. The balance sheet data of the two companies at the time of merger are as follows:

The shareholders of Brown Company agree to accept 4,000 shares of Obscure Advertising's \(\$ 10\) par value shares in exchange for the net assets of Brown Company in a business combination considered to be a pooling of interests.

\section*{Required}

a. Give the journal entry to be recorded by Obscure Advertising when it issues its shares in exchange for the net assets of Brown Company.

b. Prepare the balance sheet for Obscure Advertising immediately following the merger.

c. Give the journal entry to be recorded by Obscure Advertising if it issues its 4,000 shares in exchange for all of the common stock of Brown Company, instead of for Brown's net assets, and if both companies remain as separate corporations.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King