On 1 January 2005 entity A originated a ten-year 7 per cent EUR 2m loan. The loan

Question:

On 1 January 2005 entity A originated a ten-year 7 per cent EUR 2m loan. The loan carried an annual interest rate of 7 per cent payable at the end of each year and is repayable at par at the end of 2014. Entity A charged a 1.25 per cent (EUR 25,000) non-refundable loan origination fee to the borrower and also incurred EUR 50,000 in direct loan origination costs.

The contract specifies that the borrower has an option to prepay the instrument and that no penalty will be charged for prepayment. At inception, the entity expects the borrower not to prepay.

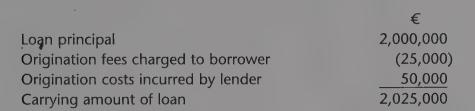

The initial carrying amount of the loan asset is calculated as follows:

(a) Should the prepayment option be separately accounted for?

(b) Determine the carrying amount of the loan at the end of each year until its maturity.

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone