On 1 January 20x2, I-Co entered into a joint-venture agreement to incorporate a new company called A-Co.

Question:

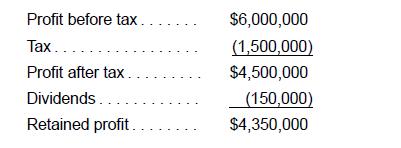

On 1 January 20x2, I-Co entered into a joint-venture agreement to incorporate a new company called A-Co. I-Co’s initial investment in A-Co was $10,000,000, which was 30% of the initial start-up capital. The following information relates to A-Co for the year ended 31 December 20x2:

Required

1. Assume that if I-Co had a choice between the cost and equity method, what amounts would be reported for the following items under either method?

(a) The after-tax income from A-Co for the year ended 31 December 20x2; and

(b) The carrying amount of A-Co as at 31 December 20x2.

2. Consider the arguments put forward by V. Mazay, T. Wilkins and I. Zimmer, “Determinants of the Choice of Accounting for Investments in Associated Companies”, Contemporary Accounting Research, Vol. 10 No. 1 (Fall 1993). Their paper focuses on the motivations for the choice between cost and the equity accounting methods. Using insights from the paper and your own critical analysis, explain which of the two methods would be preferred by the following groups and under what conditions.

(a) I-Co’s management;

(b) I-Co’s equity holders; and

(c) I-Co’s lenders.

A note on non-elimination of profits arising from transactions with associates by Mazay et al.: When an investor sells to an associate or subsidiary, a profit may be earned and recorded in the books of the investor. The profit arises when the transfer price is at a mark-up to the original cost incurred by the investor. The associate or subsidiary that buys the goods will then sell to an external party and record a cost of sale based on the transfer price. If the two transactions (the original sale and the resale) are made within the same period, there is no issue with any “unrealized profit” as the sales recorded by the investor will be offset by the cost of sales recorded by the associate.

However, when the two sales are not in the same period, an unrealized profit arises from an intragroup transaction.

From the group’s perspective, this profit does not exist as it arises from a sale to a related party within the group. It is also a result of intragroup transfer pricing, which has not been ratified by an external market transaction. (The above arguments also hold when the associate or subsidiary sells to the investor.) Unrealized profits must be adjusted out in equity accounting and consolidation. The cost method, however, emphasizes the legal entity perspective: the investor and associate are deemed as two unrelated parties and the “unrealized” profit arising from the sale is deemed as earned.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah