On 31 December 20x1, Major Corporation, whose functional and presentation currency is the dollar, acquired Minor Company,

Question:

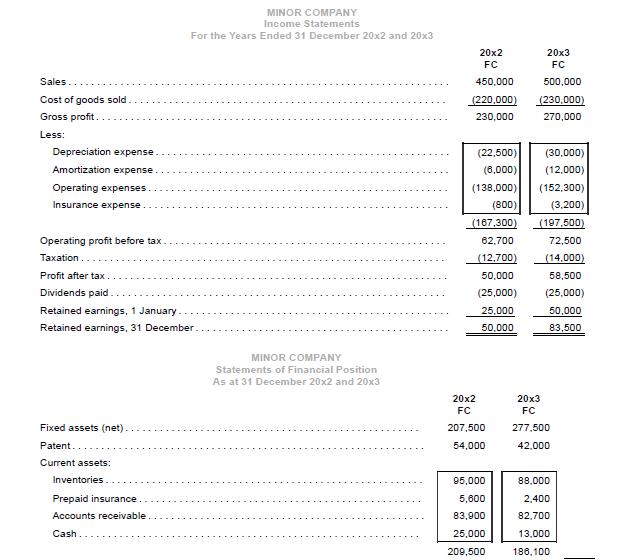

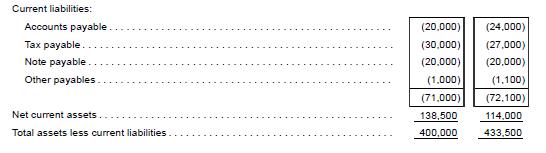

On 31 December 20x1, Major Corporation, whose functional and presentation currency is the dollar, acquired Minor Company, which operated in country X whose currency is the FC, by purchasing the entire share capital at book value. Minor’s financial statements for the years ended 31 December 20x2 and 20x3 are shown below.

Additional information

(a) At the date of acquisition, Minor Company’s equity comprised share capital of FC 230,000 and retained earnings of FC 25,000.

(b) Minor used FIFO inventory valuation. Purchases were made uniformly throughout the year. Opening inventories for 20x2 amounted to FC 87,000. Ending inventories for 20x2 and 20x3 were composed of units purchased when the exchange rates were FC 1 = $0.39 and FC 1 = $0.35, respectively.

(c) The insurance premium for a two-year policy was paid on 1 October 20x2.

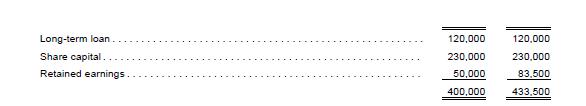

(d) Fixed assets comprised plant and equipment that were acquired as follows:

(e) Plant and equipment were depreciated over ten years on a straight line basis with no residual value. A full month’s depreciation was taken in the month of acquisition.

(f) The patent was acquired on 10 July 20x2 at a cost of FC 60,000. The estimated life of the patent was five years from the date of purchase.

(g) Minor Company was incorporated on 1 January 20x1.

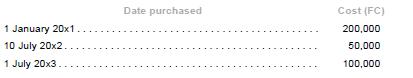

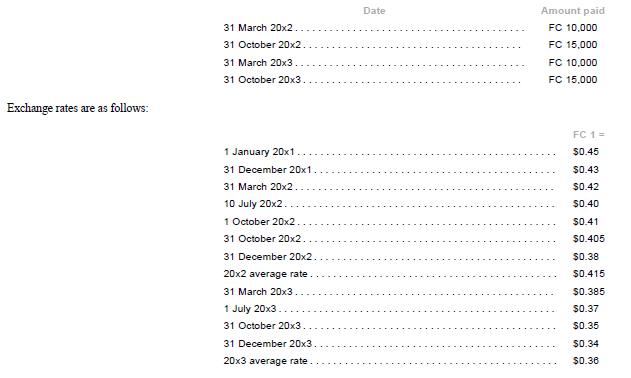

(h) Payments of dividends for 20x2 and 20x3 are as follows:

Required

Assume that the functional currency of Minor Company is the local currency, the FC. Translate the financial statements of Minor Company for the purpose of consolidation into Major’s presentation currency for the years ended 31 December 20x2 and 20x3. Prepare a schedule to show the proof of translation gain or loss.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah