On December 31, 2009, Lara acquired all the issued shares of Jade. On this date, the share

Question:

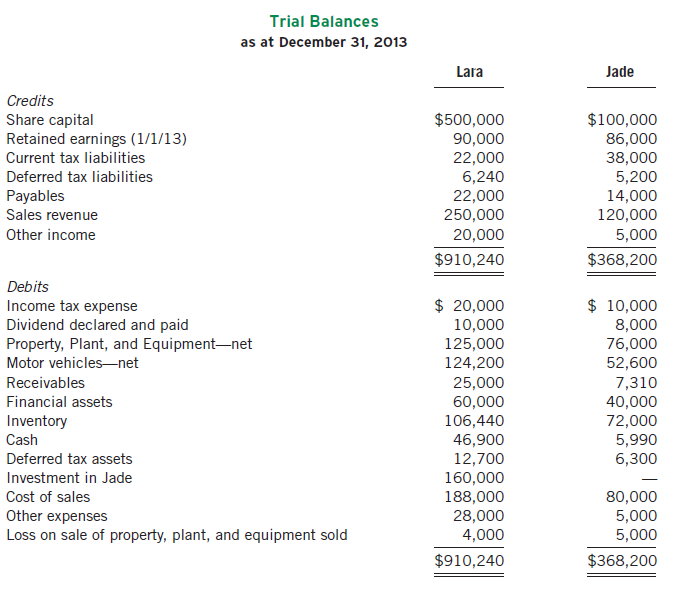

On December 31, 2009, Lara acquired all the issued shares of Jade. On this date, the share capital of Jade consisted of 200,000 shares paid at $0.50 per share. Retained earnings of Jade at this date were $45,000. At December 31, 2009, all the identifi able assets and liabilities of Jade were recorded at fair value except for some plant and machinery. This plant and machinery, which cost $100,000, had a carrying amount of $85,000 and a fair value of $90,000. The estimated remaining useful life was 10 years. Immediately after acquisition, a dividend of $10,000 was declared and paid out of retained earnings. The trial balances of Lara and Jade at December 31, 2013, were as shown below:

Additional information:

1. During the current period, Lara sold inventory to Jade for $20,000. This had originally cost Lara $18,200. Jade has, by December 31, 2013, sold half this inventory for $12,310.

2. One of the plant items held by Lara at December 31, 2013, had been purchased from Jade on July 1, 2010, for $25,000. It had a carrying amount to Jade of $17,500. Lara depreciates straight line over 10 years.

3. At January 1, 2011, Jade sold land to Lara for $50,000. This item cost Jade $55,000.

4. The tax rate is 30%.

Required

Prepare the consolidated financial statements as at December 31, 2013.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: