On December 31, 20X7, Mr. and Mrs. McManus owned a parcel of land held as an investment.

Question:

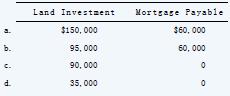

On December 31, 20X7, Mr. and Mrs. McManus owned a parcel of land held as an investment. They had purchased it for $95,000 in 20X0, and the mortgage on it had a principal balance of $60,000 at December 31, 20X7. On this date, the land’s fair value was $150,000. In the McManuses’ December 31, 20X7, personal statement of financial condition, at what amount should the land investment and mortgage payable be reported?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 9781260165111

12th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd

Question Posted: