On January 1, 20X1, Pesto Corporation purchased 90 percent of Sauce Corporations common stock at underlying book

Question:

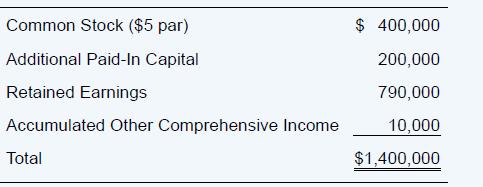

On January 1, 20X1, Pesto Corporation purchased 90 percent of Sauce Corporation’s common stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of Sauce Corporation’s book value. Pesto uses the equity method in accounting for its investment in Sauce. The stockholders’ equity section of Sauce at January 1, 20X5, contained the following balances:

During 20X4, Sauce sold goods costing $30,000 to Pesto for $45,000, and Pesto resold 60 percent of them prior to year-end. It sold the remainder in 20X5. Also in 20X4, Pesto sold inventory items costing $90,000 to Sauce for $108,000. Sauce resold $60,000 of its purchases in 20X4 and the remaining $48,000 in 20X5. In 20X5, Pesto sold additional inventory costing $30,000 to Sauce for $36,000, and Sauce resold $24,000 of it prior to year-end. Sauce sold inventory costing $60,000 to Pesto in 20X5 for $90,000, and Pesto resold $48,000 of its purchase by December 31, 20X5. Pesto reported 20X5 income of $240,000 from its separate operations and paid dividends of $150,000. Sauce reported 20X5 net income of $90,000 and comprehensive income of $110,000. Sauce reported other comprehensive income of $10,000 in 20X4. In both years, other comprehensive income arose from an increase in the market value of items designated as a cash flow hedge. Sauce paid dividends of $60,000 in 20X5.

Required

a. Compute the balance in the investment account reported by Pesto at December 31, 20X5.

b. Compute the amount of investment income reported by Pesto on its investment in Sauce for 20X5.

c. Compute the amount of income assigned to noncontrolling shareholders in the 20X5 consolidated income statement.

d. Compute the balance assigned to noncontrolling shareholders in the consolidated balance sheet prepared at December 31, 20X5.

e. Pesto and Sauce report inventory balances of $120,000 and $100,000, respectively, at December 31, 20X5. What amount should be reported as inventory in the consolidated balance sheet at December 31, 20X5?

f. Compute the amount reported as consolidated net income for 20X5.

g. Prepare the consolidation entries needed to complete a consolidation worksheet as of December 31, 20X5.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd