On January 1, 20X2, Fischer Corporation purchased 90 percent of the common shares and 60 percent of

Question:

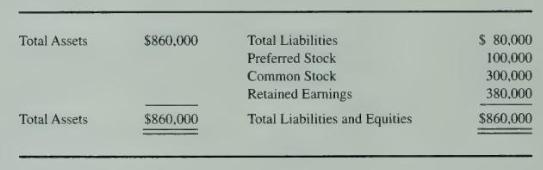

On January 1, 20X2, Fischer Corporation purchased 90 percent of the common shares and 60 percent of the preferred shares of Culbertson Company at underlying book value. The balance sheet of Culbertson Company at the time of purchase contained the following balances:

The preferred shares are cumulative with regard to dividends. The shares have a 12 percent annual dividend rate and are five years in arrears on January 1, 20X2. All the \(\$ 10\) par value preferred shares are callable at \(\$ 12\) per share after December 31, 20X0. During 20X2, Culbertson Company reported net income of \(\$ 70,000\) and paid no dividends.

\section*{Required}

a. Compute the contribution of Culbertson Company to consolidated net income for \(20 \mathrm{X} 2\).

b. Compute the amount of income to be assigned to the noncontrolling interest in the \(20 \mathrm{X} 2\) consolidated income statement.

c. Compute the portion of the retained earnings of Culbertson Company assignable to its preferred shareholders on January 1, 20X2.

d. Compute the book value of the common stock on January 1, \(20 \mathrm{X} 2\).

\(e\). Compute the amount to be reported as the noncontrolling interest in the consolidated balance sheet on January \(1,20 \times 2\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King