On January 1, 20X3, Rose Corporation purchased 25% of the outstanding shares of Jasmine Corporation at a

Question:

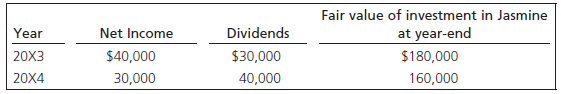

Assume that Rose Corporation exercised significant influence over Jasmine Corporation during 20X3 and 20X4 and used the equity method to record and report its investment in Jasmine Corporation. On January 2, 20X5, Rose€™s 25% interest in Jasmine had a fair value of $160,000. Now assume that on January 2, 20X5, Rose sold 5% of Jasmine€™s shares for $32,000, retaining the remaining 20% ownership of Jasmine. Jasmine€™s net income for 20X5 was $60,000, and it declared and paid $40,000 as dividends that year. Rose continued to exercise significant influence over Jasmine and to record and report its investment in the latter using the equity method. Show the journal entries that Rose has to make in 20X5 in relation to the partial sale of Jasmine€™s shares and the remaining investment in Jasmine.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay