On January 1, 20X4, Alum Corporation acquired Franco Company, a French subsidiary, by purchasing all the common

Question:

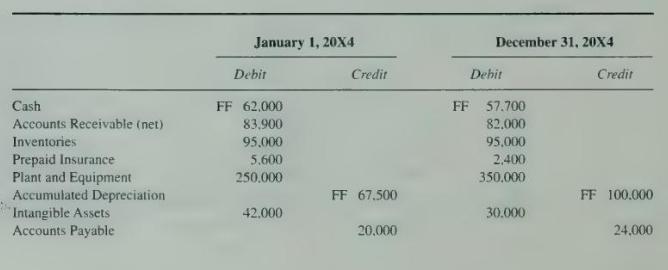

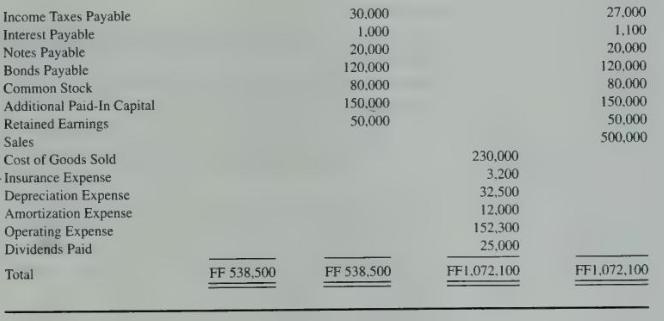

On January 1, 20X4, Alum Corporation acquired Franco Company, a French subsidiary, by purchasing all the common stock at book value. Franco's trial balances on January 1, 20X4, and December 31, 20X4, expressed in French francs (FF), are as follows:

1. Franco uses FIFO inventory valuation. Purchases were made uniformly during 20X4. Ending inventory for \(20 \mathrm{X} 4\) is comprised of units purchased when the exchange rate was \(\$ .25\).

2. The insurance premium for a two-year policy was paid on October 1, \(20 \times 3\).

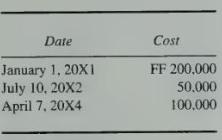

3. Plant and equipment were acquired as follows:

4. Plant and equipment are depreciated using the straight-line method and a 10-year life with no residual value. A full month's depreciation is taken in the month of acquisition.

5. The intangible assets are patents acquired on July \(10,20 \mathrm{X} 2\), at a cost of FF 60,000 . The estimated life is five years.

6. The common stock was issued on January \(1,20 \mathrm{X} 1\).

7. Dividends of FF 10,000 were declared and paid on April 7. On October 9, FF 15,000 of dividends were declared and paid.

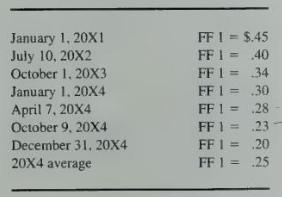

8. Exchange rates were as follows:

\section*{Required}

a. Prepare a schedule translating the December 31, 20X4, trial balance of Franco Company from francs to dollars.

b. Prepare a schedule calculating the translation adjustment as of the end of \(20 \times 4\). The net assets on January \(1,20 \mathrm{X} 4\), were FF 280,000 .

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King