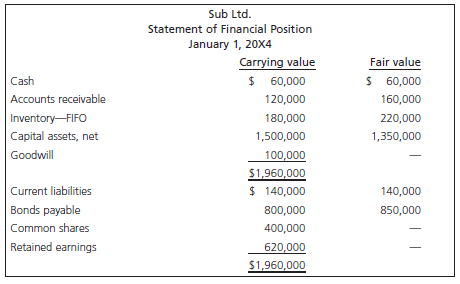

On January 1, 20X4, Parent Ltd. purchased 90% of the shares of Sub Ltd. for $972,000. At

Question:

The bonds were issued at par and will mature in 10 years. Sub Ltd. has a receivables and inventory turnover of greater than six times per year. The capital assets have an average of 10 years of remaining life and are being amortized straight-line. The annual tests for goodwill impairment have indicated no impairment of goodwill since the date of acquisition.

In 20X4, Sub Ltd. sold inventory to Parent Ltd. for $320,000; the inventory had cost $260,000. At the end of 20X4, 25% was still in Parent€™s inventory, but it was all sold in 20X5.

In 20X5, Parent Ltd. sold inventory to Sub Ltd. for $275,000; the inventory had cost $200,000. At the end of 20X5, 35% was left in Sub€™s inventory.

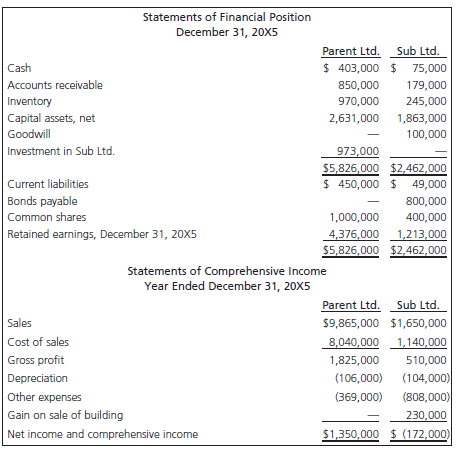

During 20X4, the subsidiary earned $875,000 and paid dividends of $50,000. During 20X5, the subsidiary incurred a loss of $172,000 and paid dividends of $60,000.

The parent company used the cost method for the investment in the subsidiary and netted almost everything to €œOther expenses.€

At December 31, 20X5, the following financial statements were available:

Required

a. Prepare a consolidated statement of comprehensive income for 20X5 under the entity method.

b. Calculate the amounts that would appear on the consolidated SFP at December 31, 20X5, under the entity method, for:

i. goodwill;

ii. capital assets, net;

iii. bonds payable; and

iv. NCI.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay