On January 1, 20X6, Big Inc. acquired 100% of the outstanding shares of Small Corp. for $15,000,000

Question:

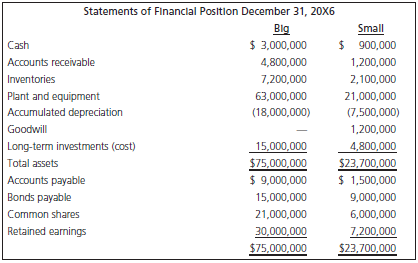

The statements of financial position of the two companies on December 31, 20X6, are shown below.

Additional Information:

1. The goodwill on Small€™s books arose from the purchase of another company several years ago, a company that has since been amalgamated into Small. The goodwill was assumed to have a fair value of zero on January 1, 20X6.

2. Small€™s plant and equipment have an estimated average remaining life of 10 years from January 1, 20X6. The net carrying value of the plant and equipment was $15,000,000 on that date, after deducting $6,000,000 of accumulated depreciation.

3. On January 1, 20X6, Big held inventory of $1,200,000 that had been purchased from Small. Small had sold the merchandise to Big at a 50% gross profit on the sale price.

4. On December 31, 20X6, Big held inventory of $1,500,000 that had been purchased from Small during 20X6 at a 50% gross profit on the sale price.

5. At the end of 20X6, Big owed Small $600,000 for merchandise purchased on account.

6. During 20X6, Small sold an investment for $1,200,000. The investment had cost Small $540,000, and had a fair value of $900,000 on January 1, 20X6.

7. Big€™s retained earnings on December 31, 20X6, include dividend income received from Small. Small declared dividends of $600,000 in 20X6.

Required

Prepare a consolidated statement of financial position for Big Inc. at December 31, 20X6.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay