On January 1, 20XI, Alpha Corporation acquired all of the assets and liabilities of Bravo Company by

Question:

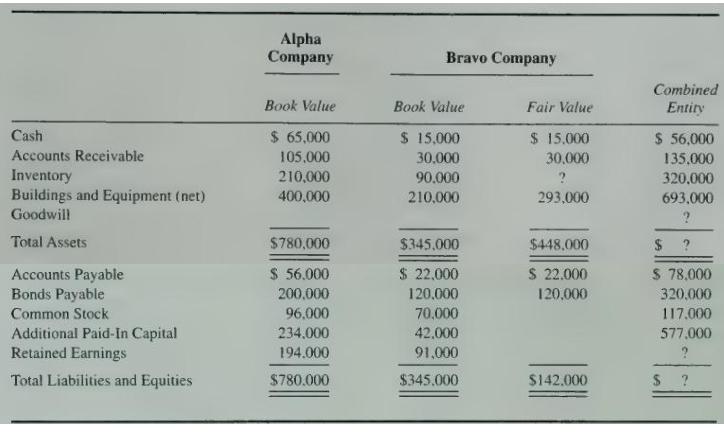

On January 1, 20XI, Alpha Corporation acquired all of the assets and liabilities of Bravo Company by issuing shares of its \(\$ 3\) par value stock to the owners of Bravo Company in an exchange recorded as a purchase. Alpha also made a cash payment to Banker Corporation as a finder's fee. Partial balance sheet data for Alpha and Bravo before the cash payment and issuance of shares and a combined balance sheet following the business combination are as follows:

\section*{Required}

a. What number of its \(\$ 5\) par value shares did Bravo Company have outstanding at January 1, 20X1?

b. Assuming all of Bravo's shares were issued when the company was started, what was the price per share received at the time of issue?

c. How many shares of Alpha Company were issued at the date of combination?

d. What was the market value of the shares of Alpha Company issued at the date of combination?

\(e\). What amount of cash did Alpha pay to Banker Corporation as a finder's fee?

f. What was the fair value of Bravo's inventory at the date of combination?

g. What was the fair value of Bravo's net assets at the date of combination?

\(h\). What amount of goodwill, if any, will be reported in the combined balance sheet following the combination?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King