On January 1,20X1, the partners of Able, Black, and Ciou, who share profits and losses in the

Question:

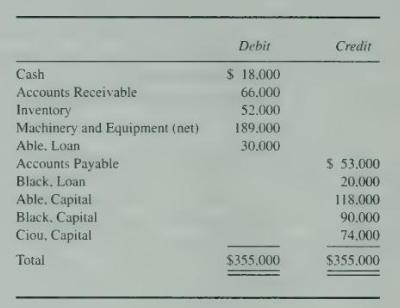

On January 1,20X1, the partners of Able, Black, and Ciou, who share profits and losses in the ratio of 5:3:2, respectively, decide to liquidate their partnership. The partnership trial balance at this date is as follows:

The partners plan a program of piecemeal conversion of assets in order to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month. No interest accrues on partners' loans during liquidation. A summary of the liquidation transactions is as follows:

January 20XI:

1. \(\$ 51.000\) was collected on accounts receivable; the balance is uncollectible.

2. \(\$ 38.000\) was received for the entire inventory.

3. \(\$ 2.000\) liquidation expenses were paid.

4. \(\$ 50.000\) was paid to outside creditors, after offset of a \(\$ 3.000\) credit memorandum received on January \(11,20 \mathrm{X} 1\).

5. \(\$ 10,000\) cash was retained in the business at the end of the month for potential unrecorded liabilities and anticipated expenses.

February 20X1:

6. \(\$ 4,000\) liquidation expenses were paid.

7. \(\$ 6,000\) cash was retained in the business at the end of the month for potential unrecorded liabilities and anticipated expenses.

March 20X1:

8. \(\$ 146,000\) was received on sale of all items of machinery and equipment.

9. \(\$ 5.000\) liquidation expenses were paid.

10. The \(\$ 30.000\) loan from Able is approved by the partners for offset against his capital account.

11. No cash was retained in the business.

\section*{Required}

Prepare a statement of partnership liquidation for the partnership with schedules of safe payments to partners.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King